Welcome to Unmade, written in a pleasant hotel room while gazing across Darling Harbour at James Packer’s monstrous carbuncle.

Today: The verdict on Paramount’s Upfront event, plus the latest from the Unmade Index.

Unmade’s paying members got this 90 minutes before everyone else. That could be you

A message from our sponsor:

How do you judge a great digital environment for your advertising?

The best way is whether it catches the attention of your customer and enables your brand to embed itself in their memory. Because ads that command attention stay in consumer’s minds influencing future purchase decisions.

A study by Mediascience found that on the path to purchase, premium digital environments produce significantly more unprompted recall than Facebook, YouTube and longtail websites, meaning premium digital is a fast track to mental availability – a fancy term for memory.

Next time you want to make a lasting impression, ThinkPremiumDigital.

(Wait and) See Tomorrow

Of the big three, we’re now two Upfronts in. Nine went first, back in mid-September, and yesterday it was the turn of Ten’s owner, Paramount, which took over the ICC for the afternoon to tell us its plans for 2023.

(A declaration of interest before you read on: like a number of interstate visitors to the event, my travel and accommodation was paid for by Paramount.)

Returning from the pandemic live event hiatus, there have been new Upfronts themes. Both Nine and Ten opened with performances from indigenous Australians. Both leaned into the dry ice. Nine went for flames, while Ten had glitter cannons in the ceiling. Both gave almost as much prominence to their tech partnerships as they did the content slate. And both emphasised the scale of their wider companies.

This is where they begin to diverge.

In Nine’s case, the scale comes from width - the multi-platform nature of the company, with TV, radio and publishing offerings. In the case of Paramount, the scale comes from depth - being the only free to air network that’s part of a global media organisation. Being the people who brought you Top Gun is quite the halo.

While Nine’s theme last month was “Australia belong here”, Paramount’s was “See tomorrow”.

As you’ll see from the top of this page, there’s also audio embedded, and available as a podcast to accompany this post. Earlier this week, I interviewed Paramount’s content boss Beverley McGarvey and commercial boss Jarrod Villani and we talked not just about 2023, but the company more widely.

I realised that I had automatically labelled the file where I stored my interview notes “Paramount”, not “Ten”. Five years after Ten was bought out of administration by CBS (which quickly became Viacom-CBS and then Paramount), it now feels like a company that adds up to more than Ten-and-the-other-bits.

Paramount owns not just the pay TV brands of MTV and Nickelodeon, but also the subscription streaming platform Paramount Plus and, as the company announced yesterday, the free ad supported TV channels offering of Pluto TV.

The hot new acronym is FAST - free ad-supported streaming television. FAST will be as important to the next phase of the TV networks as the launch of BVOD (broadcast video on demand) was five or six years ago. It’s the next TV battleground.

Viewers consume FAST channels differently to video on demand. For anyone who’s lost half an hour dithering over a menu of shows, FAST restores the curation of broadcast, and that means more video consumption.

The point of FAST channels is that, like broadcast television, the choice is made for the viewer. It’s lean back, not lean forward. Channel surfing is back too.

I wrote about the likely arrival of Pluto TV late last year, so it’s not a surprise to see it coming.

As you’ll hear in the podcast, Paramount is being cagey about how many Pluto channels will be offered initially as part of its free 10play streaming platform. When I pushed Villani on it a couple of times, all he’d share was “a number”. Although he wouldn’t say so, I understand that number will be initially be between 10 and 20. In terms of timing, Villani said it would be this side of Christmas.

My guess is that just as Ten All Access rebranded to Paramount Plus, in time 10play will fully rebrand to Pluto TV. Pluto is big business for Paramount globally, already writing a billion dollars in revenues.

Nine announced at its Upfront that it will launch its own FAST channels, but had so little detail my guess is that it is some way off launch. For something so strategically important that feels like a miss.

Meanwhile, Seven West Media - which holds its Upfront in just over a fortnight from now - was actually first mover in this market and already offers 50 FAST channels on Seven Plus in addition to its broadcast brands.

Another point of difference for Ten was that unlike Nine, it revealed its programming grid for the year. Curiously, it broke 2023 into two uneven halves - the eight months up to August, and the final four from September onwards.

In recent years Ten has started its main schedule early, while Nine and Seven are still airing their summer sports of tennis and cricket. But I’m A Celebrity will no longer kick off Ten’s year, shifting back to Easter, with production returning to Africa rather than the rain forest of Murwillumbah.

Instead, Ten will start the year with The Bachelors, as it remixes the format with three Bachelors instead of one. It will also be resting companion series The Bachelorette this year. The revised format had previously been announced, but footage from the show got one of the strongest reactions in the room yesterday. I could see myself enjoying hate watching these nitwits.

Conversely, I suspect that the Paramount team would have been more disappointed with the in-room reaction to the announcement of a local version of the UK show Taskmaster. It is well cast with Tom Gleeson as the local Taskmaster, but it’s one of those shows that unless you’ve seen it, it’s hard to understand the appeal. Although it will run in the first half, it’s not yet in local production, so there were no clips. Extracts from the UK version didn’t do much to advance that understanding. The Ten promo department usually does a better job.

That said, the chase format Hunted, which launched last year, was similarly hard to capture in a sizzle reel beforehand, but that didn’t stop it from being one of Ten’s successes of 2022.

Other detail for the first half included a shorter series of Masterchef than usual, and a UK-Australian co-production of cop-out-of-water comedy drama North Shore.

The other trailer which got a big reaction was Last King of the Cross, the Underbelly-style glorification of the less than savoury John Ibrahim. This will run in the second half of 2023.

There are more new formats in H2.

Ten will offer a spin-off from Masterchef, Dessert Masters. It says it will also air a second season of The Traitors, a murder mystery guessing game hosted by Rodger Corser. There was already footage in the can of this one from season one, which airs shortly. The trailer felt more like a dinner party game than primetime.

Bravely, Ten also announced a second season of The Real Love Boat. In an awful piece of timing, it made its debut on Wednesday night to poor ratings of just 215,000 metro viewers. Unless those improve dramatically over the next couple of weeks, there seems little prospect of that making the 2023 schedule despite what the grid said.

Meanwhile, the announcements about technology were tactical rather than strategic.

A shop-the-tweet integration between Ten and Twitter called The Checkout felt a few years late. remember companion apps?

And a number of announcements around connected television advertising integration and measurement came across as necessary but not particularly exciting plumbing.

The See Tomorrow theme was appropriate for a number of reasons. The major one is that we are yet to see the Paramount spending power unleashed on sport. The company only narrowly missed out on AFL rights last month. Imagine how different yesterday’s event would have been if it had won.

Instead Villani referred on stage a couple of times to the $12bn parent company’s financial strength. You don‘t have to read too far between the lines to see that as a willingness to continue to chase big sports rights. As the network that made Big Bash a hit in the first place, Ten is a more natural home for short form cricket than Seven. And to a global company like Paramount, the Olympics must be of major interest too.

Sport is the major missing piece for Paramount. In the last financial year, Ten’s revenue share of the metro broadcast advertising market was less than 24%, while Nine and Seven did about 38% each. Ten can only grow that by growing its audience.

See tomorrow? We will eventually.

Unmade Index

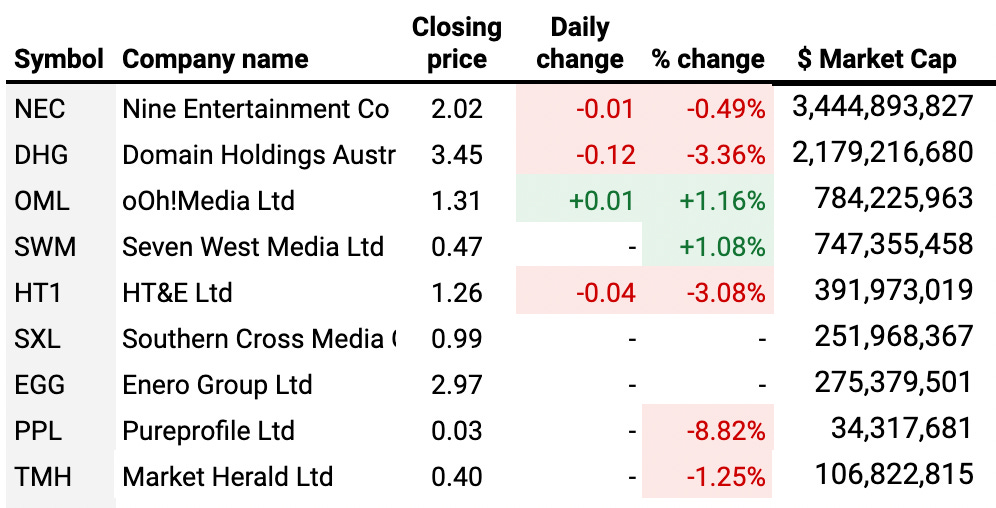

After the Unmade Index of ASX-listed media and marketing stocks shot up by nearly 9% in two days, yesterday was more flat, with the index drifting down 0.68%

Most notably though, Seven West Media and Ooh Media both continued to grow. SWM has now added nearly $100m to its market cap in the space of three days.

Time to let you get on with your Friday. I’ll be back with best of the Week tomorrow.

Audio production on the podcast was courtesy of Abe’s Audio, the people to talk to about voiceovers and sound design for corporate videos, digital content, commercials and podcasts.

Have a great day

Toodlepip…

Tim Burrowes

tim @unmade.media