Welcome to an audio-led edition of Unmade. Today, we talk to the architect of AI-led ad agency Cuttable. And Nine’s shares sink as the market awaits a plan for life after Domain.

To get maximum value from a paid membership of Unmade, sign up today.

Your annual membership gets you tickets to September’s REmade conference on retail media; to October’s Unlock conference on marketing in the nighttime economy; and to Unmade’s Compass end-of-year roadshow.

You also get access to our paywalled archive.

Upgrade today.

Betting on Meta - How Cuttable is targeting SMEs

In today’s audio-led edition of Unmade we talk to the co-founder of AI-powered ad agency, Cuttable.

Cuttable, founded by creative agency exec Jack White, former Swisse marketer Ed Ring, and tech entrepreneur Sam Kroonenburg, was initially serving some of the biggest brands in the country – Medibank, Wesfarmers, and Nando’s, to name a few.

But over the past 12 months, the Melbourne-based startup has pivoted to the smaller end of town. Now focused on the “97%” of brands that have grown up entirely in the social media era, it has turned its attention to those relying on Meta for growth.

The shift wasn’t just a tactical decision, it was a bet on where the future of brand building is heading. White believes the next decade will belong to businesses born and scaled on social media, and he wants Cuttable to be the engine that powers them.

“It was a hard decision, we had good revenue. We nearly hit one million [dollars] in ARR (annual recurring revenue), but we made that choice to hand back some of the money to the bigger brands.”

He says smaller businesses, founder-led businesses, benefit most from Cuttable’s capabilities. The entrenched processes of larger brands – strict brand guidelines, layers of approval, disjointed agency villages – slow down testing and learning too much. In comparison, the nimble nature of smaller brands means they are able to iterate at speed, and they are far hungrier for the immediate impact Cuttable can deliver.

That hunger, White says, is driven by necessity: “They’re doing their best to keep up with the volume and pace [of advertising] but they’re struggling, because they’re not advertisers. They care about their brands, they’re literally spending their nights and weekends making ads.”

Across Cuttable’s client base, 80–90% of ad budgets are funnelled into Facebook, Instagram, and Marketplace. White notes that these channels demand constant “creative variation” – a steady stream of fresh ads that keep the algorithm engaged. It’s a requirement that overwhelms small marketing teams but plays to Cuttable’s strength: generating high-quality, high-volume creative without human bottlenecks.

While some might see a risk in focusing so heavily on one platform – especially as Meta invests in its own AI ad tools – White is confident Cuttable’s edge lies in combining tech expertise and automation with advertising know-how. The team includes talent from TBWA, Ogilvy, Medibank, and Meta itself, all working alongside top engineers to blend industry craft with cutting-edge tech.

“Anyone can spit out content,” he says, “but making something people actually want to click on still takes a good idea.”

That blend is also what’s attracting investors. Cuttable has raised $10m on a valuation of $44.5m, with backers including Square Peg and The Brand Fund. The capital is fuelling not just product development but an ambitious expansion into the US, where White sees an even larger market of small and medium brands battling the same challenges.

Nine fades as market awaits annual update

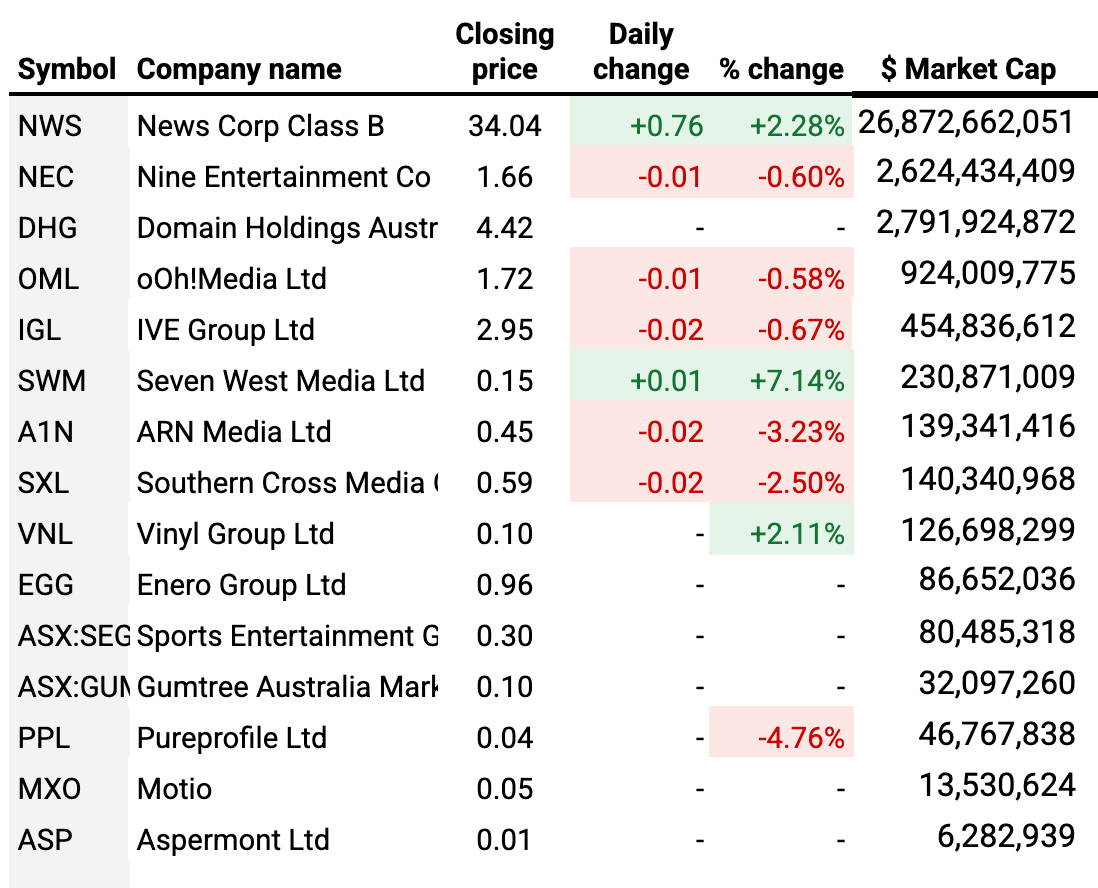

Nine’s share price continued to sag today, losing another 0.6%. The company has now lost more than 5% in recent days as its most keenly anticipated full year results announcement in some years approaches.

On August 27 - just under a fortnight from now - the company will receive the $1.4bn proceeds from the sale of Domain on the same day it releases its FY25 financial update. Shareholders expect to receive a share of the cash, along with some of the company’s debt being paid down. However, just as keenly anticipated is for Nine CEO Matt Stanton to share a new vision for the TV-led business, including any potential new acquisition strategy.

On Tuesday Seven West Media set the tone for results season with a downbeat set of numbers, albeit with a slight improvement in the second half of the year. SWM shares improved by 7.1% today, after losing 6.7% on Tuesday.

The two major audio players both had down days, with Southern Cross Austereo losing 2.5% to land on a market capitalisation of $140.3m, just ahead of the $139.3m of ARN Media, which lost 3.2%.

Ooh Media lost 0.6% to land on a market cap of $924m.

The Unmade Index closed on 571.4 points, down 0.68% for the day.

More from Mumbrella…

McDonald’s split: Longest client-agency partnership in Australian advertising comes to an end

Opinion: We must fix the fan experience for football broadcasting

Paramount stocks soar after UFC deal and ‘meme stock’ comment

Today’s podcast was edited by Abe’s Audio. We’ll be back with more tomorrow.

Have a great night

Toodlepip…

Tim Burrowes

Publisher - Unmade + Mumbrella

tim@unmade.media