Welcome to a midweek update from Unmade, on the morning after News Corp’s main marketing-industry focused event of the year, D_Coded. Yesterday’s big announcement was Tubi. Two months after announcing the sale of Foxtel, News Corp is back in the TV business.

Also today, Enero’s sinking share price hits the lowest point in more than a decade.

News Corp Australia gets back into TV with Tubi

For a while now, I’ve been puzzled by Tubi.

It’s the biggest asset in the extended News Corp universe not to have a presence in Australia. In the US, Tubi is a big deal. Its share of total TV viewing is nearly 2% and it’s bigger than Peacock, Paramount+ and Max. In some quarters it’s been bigger than Disney+.

Actually, it’s not entirely true to say that Tubi has not had a presence in Australia. Tubi has been here all along and repped by Foxtel Media. But it didn’t receive much love, even as it built towards 1.3m active monthly users locally.

When I interviewed Foxtel boss Patrick Delany this time last year, I told him I was surprised they were not doing more with Tubi.

At the time, Delany argued that the reason for Tubi’s success in the US is the fact that it’s entirely free to its audience. While Australia’s free to air networks are available over the airwaves, US viewers are used to paying for everything they watch via cable. So Tubi was a bigger point of difference, he argued.

However, I suspect that was not the only reason. With Foxtel about to pass into the ownership of DAZN, Tubi now represents News Corp’s seat back at the table of television. It didn’t make sense for News Corp to go hard until the Foxtel deal was done.

Tubi has a straightforward business model. There’s no paid membership tier. It’s pureplay FAST - free ad-supported streaming TV.

That puts Tubi in the same space as 7plus, 9now, Tenplay, along with global players like Paramount’s Pluto TV. And of course, with the FAST services being offered by the connected TV providers.

Incidentally, Tubi lives within the other half of the Murdoch empire, Fox Corp. News Corp is effectively a local rep.

In today’s podcast I interview News Corp’s executive chairman Michael Miller. He pushes back against my assumption that Tubi lacks premium content. And while it’s true that Tubi has a deep archive, a look at the home page this morning reminds me of the experience of standing in the discount section of my local video store. They looked like blockbusters, but I just hadn’t heard of them.

(Titanic 2, anyone? Jack’s back… and he’s got a score to settle about the whole floating door episode.)

Tubi’s secret weapon is the world’s favourite price point: free. There are plenty of Australians who can’t or won’t afford to pay for their streaming.

And its not-so-secret weapon is the marketing firepower of News Corp. Would Kayo or Binge have grown without the company’s cross promotion?

In my conversation with Miller, he places Tubi as a “top three or four” marketing priority for the year.

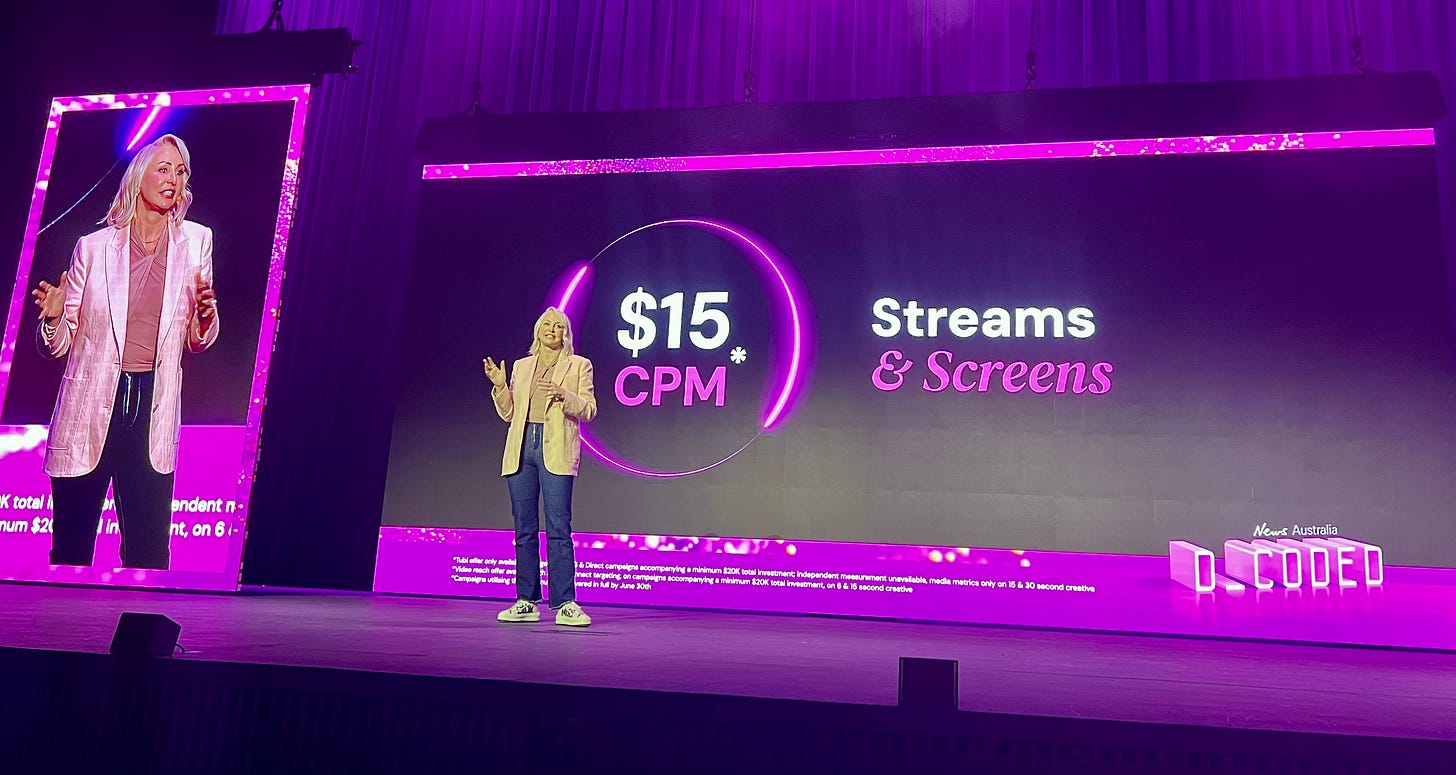

And News Corp is backing the push with an aggressive price point - a launch price of a $15cpm.

Considering that’s likely to be big brand advertising on the main lounge room screen, that’s an aggressive price.

By the way, in case you can’t read the small print on the screen behind sales boss Barrett in the photo above, the price is for campaigns with a minimum spend of $20,000, running before June 30. And “independent measurement unavailable”.

The rest of today’s conversation with Miller spans the other announcements around D_Coded, including marketer-friendly expansions of its Intent Connect planning system, and the company’s continuing efforts to make the concept of engaged reach a thing.

Miller also makes it clear that News Corp still views the coming election and US trade war concerns as a delay, not an end to the News Media Bargaining Code framework. “We have been patient,” he says.

Unmade Index fights off Trumpcession fears as Enero sinks to decade-long low

Despite an early selloff triggered by global concerns over a looming Trumpcession, the Unmade Index bounced back in later trading yesterday to finish flat.

The biggest local weight on the Unmade Index, Nine, was lifted by its majority-owned real estate platform Domain. Nine was up by 1.3%, while Domain rose 1.8%.

ARN Media was up by 4.9%, taking it back above a $200m market capitalisation.

Among stocks moving in the other direction, print and marketing group IVE lost 8.6%, while Seven West Media lost 3.2% to land on its lowest point since January. Southern Cross Austereo was down by 3.6%.

Enero Group, owner of ad agency BMF among others, slumped by 6.7% to land on its lowest share price in more than a decade.

The Unmade Index ticked up by a fraction, rising by 0.09% to land on 551.2 points.

Time to leave you to your Thursday. We’ll be back with more tomorrow.

Editing was courtesy of Abe’s Audio, the people to talk to about voiceovers, sound design and podcast production.

We’ll be back with more soon

Have a great day.

Toodlepip…

Tim Burrowes

Publisher - Unmade + Mumbrella

tim@unmade.media