Why James Warburton is Unmade's CEO of the year. And announcing The Unmade Index

During 2021, Seven West Media's market capitalisation grew by nearly half a billion dollars. Our research also reveals which ASX CEOs delivered a negative return on their remuneration

Welcome to Unmade for the final time in 2021, written at a cosy country hotel, while you were sleeping on Thursday morning.

Happy Baking Soda Day.

Greetings from Tewkesbury in the UK, where the traditional “Shall we just throw the rest of the turkey in the bin before it gives someone food poisoning?” evolved into the “shall we take a quick minibreak?” discussion.

It’s been a terrific few days. I can still see a muddy tramp in the fields in the near future.

But before that, a break from the festivities to look back on the year just gone for Australia's listed media and marketing companies: Seven West Media, Nine, Southern Cross Austereo, Ooh Media, HT&E, Prime Media, Pureprofile and Enero.

Since launching Unmade back in August, one of our areas of focus has been the performance of these ASX-listed companies. There aren’t many of them, but the transparency requirements that come with the privilege of being listed provide observers with a lot of interesting data, if you know how to interpret it.

In 2022, we’ll be diving even more deeply. We’ve been developing The Unmade Index, which will track the fluctuations of Australia’s media and marketing sector as a whole. The Unmade Index will debut next week.

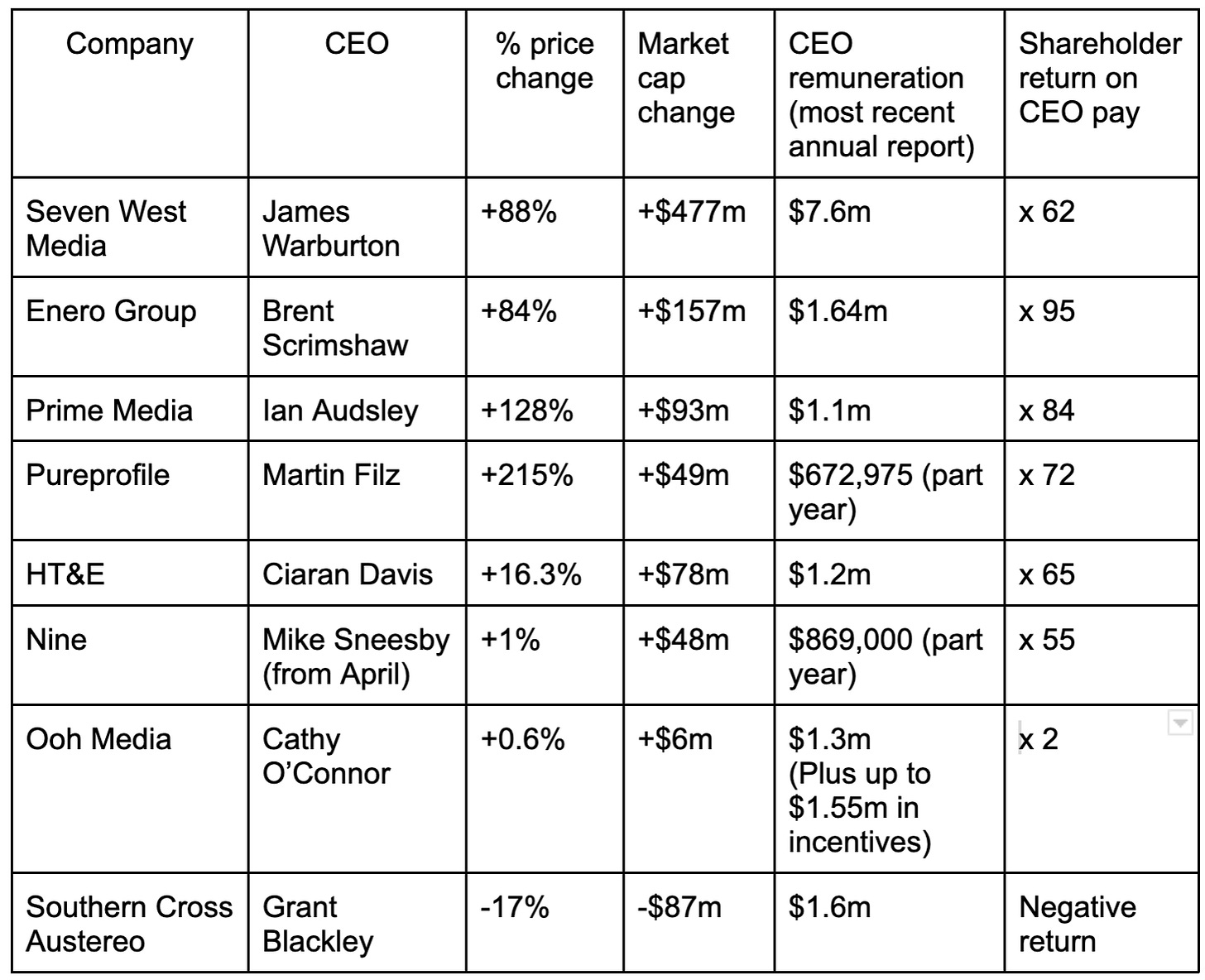

So it seems fitting that for this final edition of the year, I attempt to make some comparisons of how these listed media and marketing companies have fared in 2021 - including which CEOs gave their shareholders the best return on their sizeable pay packets (and those who did not).

Before I come to that, I should mention that this is also Unmade’s final paid post of the year. The paywall will kick in a little further down.

Full of post-Christmas cheer, I’ve created one final subscription offer for 2021, valid just for the next three days. For the last time, I’m offering more than half off the price of an annual subscription, via the button below. That means that a full year 2022 subscription will be $318.50 instead of $650.

Although I’ve selected a CEO of the year, that choice is not as arbitrary as it would be from an awards jury; it’s based on the data. However, I should acknowledge there is a subjective element to how to prioritise that data.

With two ASX trading days of the year left to go, I’m slightly hostage to fortune, but unless something truly wild happens before 2pm on Friday there will be no major changes to the situation.

There are currently 11 media and marketing companies listed on the ASX. For the purposes of the comparisons I’m about to make, I’ve excluded News Corp, because it’s dual-listed in NY, and a lot of its value is derived from outside Australia. I’ve also omitted real estate platform Domain because it’s majority owned by Nine, so its performance is captured in that listing. And I’ve left out the News Corp-aligned REA Group because much of its value comes from overseas too.

There are a number of ways to rank the best performing company, and indeed best performing CEO.

One way would be to look at which company has grown its market capitalisation in percentage terms. There’s a lot to be said for that. From a shareholder’s perspective, they don’t care about a company’s market capitalisation as much as they do about how the value of their own holding has changed in any given year.

But of course, that doesn’t capture scale, and arguably the challenges of creating significant change for a big company are harder than doing the same for a small one. So the actual dollar change in market capitalisation is an indication of overall impact.

Meanwhile, another way of examining performance of CEOs is to look at the value they have created for shareholders, as a ratio of their remuneration. Few sophisticated investors begrudge a payout to a CEO who has delivered them a decent reward. For CEOs whose strategic skills make a difference, their reward deserves to go beyond a payment for their time.

From each of the three yardsticks above, a different organisation ranks on top. Which is where I have to make some choices. The data doesn’t lie, but how you choose to interpret it provides different outcomes.

I’ve collated my data in this table:

2021 ASX performance

Let’s look at those companies…

Seven West Media

Based on the numbers, James Warburton is the obvious choice as Unmade’s ASX media company CEO of 2021.

As I write this, Seven West Media’s market capitalisation sits at $1.02bn. If you’d asked me two years ago, I would not have believed it would make it above $1bn again.