The wrong sort of consolidation

Welcome to a Monday edition of Unmade. Today: What if the cards had landed differently in the consolidation wave? And further down, most Unmade Index stocks fall, as SCA drops back below $200m.

It’s your last chance to sign up to a paid membership of Unmade and lock in all of the current benefits. Next week, we’re going to stop accepting new paying members of Unmade. Instead we’ll be offering membership of an expanded Mumbrella Pro as we bring the two brands closer together.

All Unmade membership perks will be carried across, including complimentary tickets to REmade, Unlock and Compass for our annual paying members. These won’t be available to anyone else as part of the new Mumbrella Pro membership.

Your paid membership also includes exclusive analysis and access to our content archive, which goes behind the paywall six weeks after publication.

Upgrade today.

They almost had it all

If the cards had landed just a little differently, Australia’s media landscape might have been about to enter a period of growth.

Sadly, the window of opportunity seems to be closing.

The planets almost aligned for our media players to end up as individual powerhouses in a single sector.

Let’s go back to last year’s efforts by ARN Media to take over Southern Cross Austereo and create a single main digital audio player built on Listnr. Rather than two weak radio players, it would have created a single dominant audio leader. That plan looks dead now.

Then there was the sale by News Corp of Foxtel to DAZN, followed by the decision of Optus to exit from streaming, with Nine’s Stan picking up the English Premier League rights.

Imagine if, instead, Nine and Foxtel could have reached an understanding where Stan took over Foxtel’s Binge subscribers to become the major entertainment player, while Foxtel got the Optus deal to widen its lead as the main sports streamer. With Nine also repping Warner Bros’ HBO Max it would have created a powerful local player in entertainment streaming.

And a few days ago, Mi3 reported what had been rumblings for months within the industry that Network Ten’s owner Paramount was looking to once again outsource its media sales. That moment also seems to have since passed. Assuming the Australian Competition and Consumer Commission could have been persuaded to allow it, imagine having a single buying point for free to air television across two or even all three of the main players.

If those deals could have been done, it would have created a number of stronger players within a specific medium - a dominant free to air player; a dominant audio player, and a dominant sports player. They still would not have matched the might of the platforms, but would have been more sustainable than the three-horse races each individual medium is currently experiencing.

We’re entering a period of consolidation, but it’s looking increasingly like the wrong sort of consolidation.

SCA slips below $200m

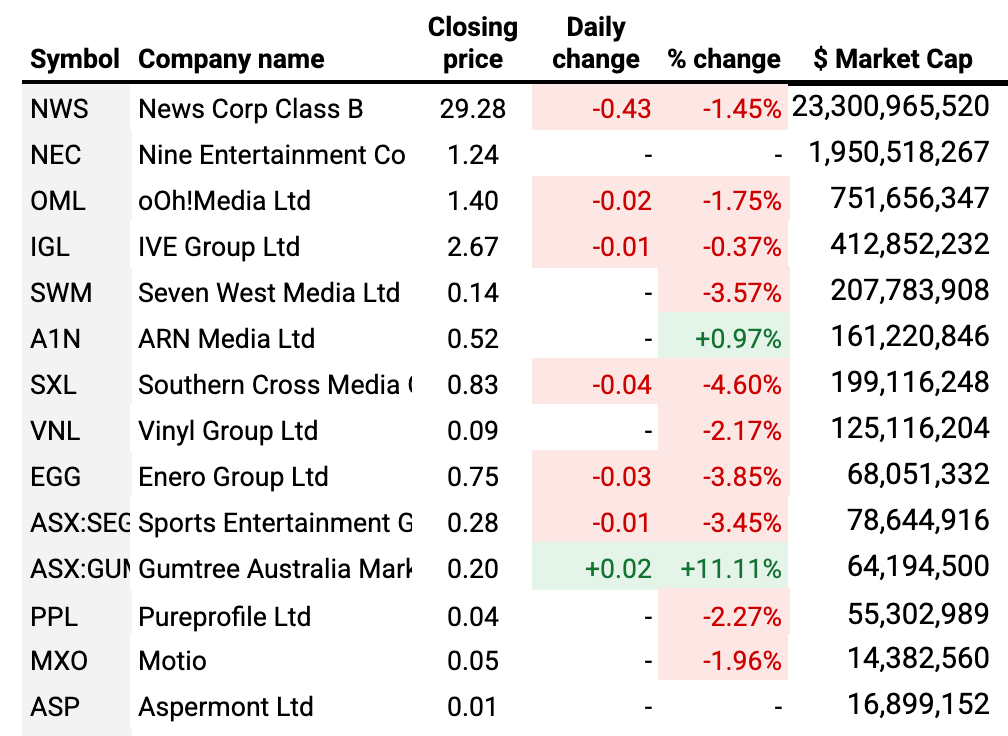

The market capitalisation of Southern Cross Austereo slipped back below $200m today, as the market continues to lose interest in the company’s merger with Seven West Media.

SCA shares lost 4.6% today, the worst result on a wide ranging selloff across the Unmade Index. SCA is now trading below its valuation prior to the deal announcement.

Ooh Media also slipped, losing 1.8% while Enero Group lost 3.9% and Vinyl Group lost 2.2%.

The Unmade Index lost 0.54% to land on 478.8 points.

More from Mumbrella…

Google reignites campaign against under-16s social media ban

Out-of-home operator Gawk ends relationship with Ooh Media, aims to win ‘divorce’

Time to leave you to your evening.

We’ll be back with more soon.

Have a great night.

Toodlepip…

Tim Burrowes

Publisher - Unmade + Mumbrella

tim@unmade.media