The worst people in the world are making the most desperate hand over their data. What could possibly go wrong?

Welcome to a Tuesday update from Unmade. Today’s full post post is for Unmade’s paying members.

Today: The ACCC has highlighted the data liberties being taken in the real estate sector - what’s the government going to do about it? And the Unmade Index lifts from its all-time low.

The Venn diagram of people who are organised enough to sign up as a paying member of Unmade; interested enough in how AI is affecting the media and marketing industry to come along to today’s HumAIn conference; and disorganised enough not to have yet bought a ticket may be quite small. But, if that’s you, for one final time in 2024, your coupon code is under the paywall. See you in four hours.

Only our paying members receive our members-only Tuesday analysis; get access to our archive where all our content is paywalled after two months; get their own copy of Media Unmade; and receive discounts on all our events. Upgrade today

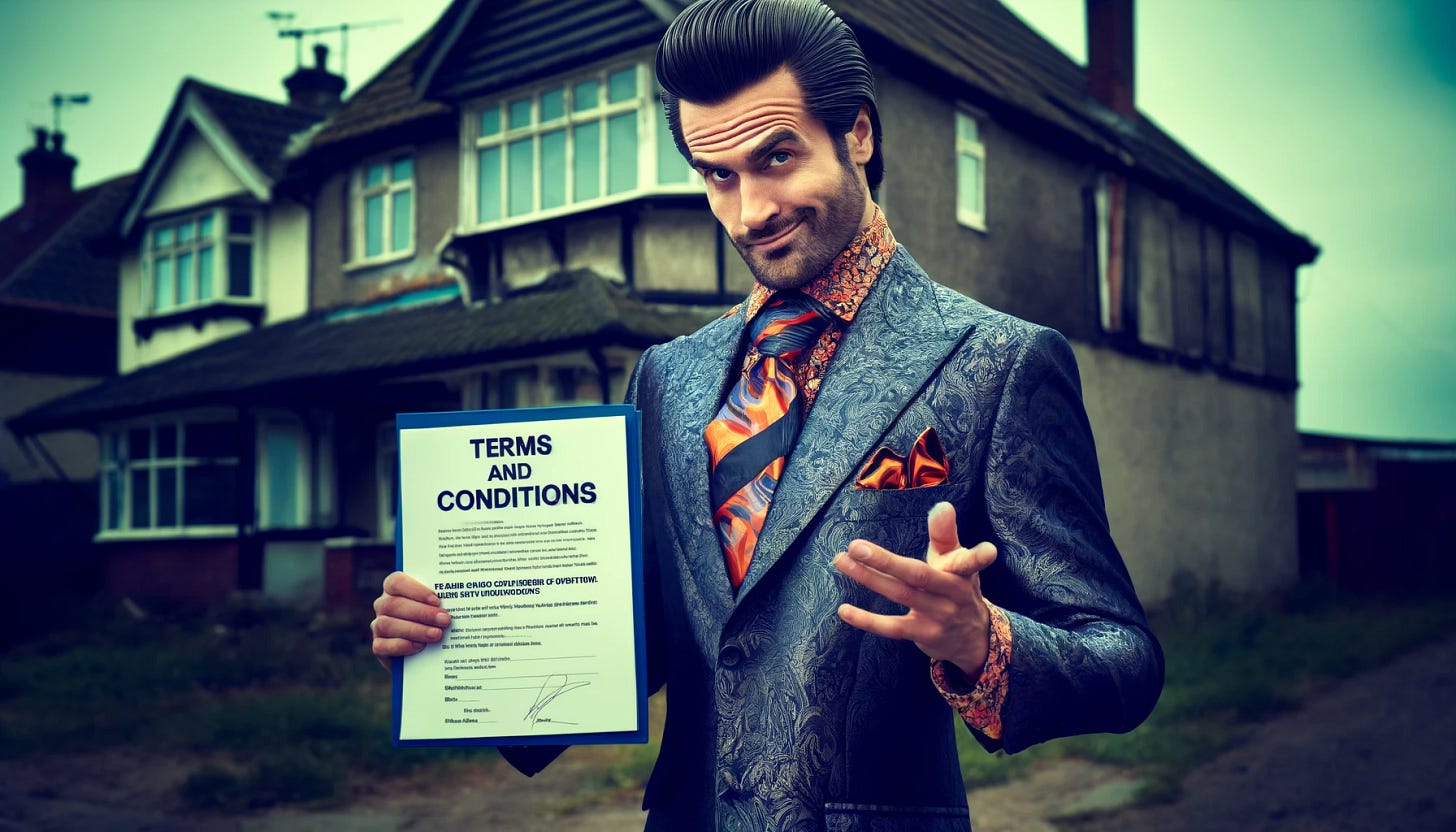

If they can’t be bothered to fix a leaking tap, can the real estate sector be trusted to avoid data leaks?

Last week the Australian Competition and Consumer Commission published the latest report from its long running Digital Platform Services Inquiry.

Like the other chapters, they do an excellent job at making the complex understandable. I’d love to buy the anonymous lead author a beer one day.

The subject of this interim report - the eighth since the five-year inquiry kicked off in 2020 is data brokers - those trafficking consumer information to marketers, financial companies and service providers.

There’s a lot in the report - including many questions around consumer privacy across the board. Much of the crosses over with the long gestating Privacy Act Review, which has been dragging on for nearly five years. The report on the review was published in February of last year, and the government published its response in September. But it is yet to legislate. (Take your time, lads.)

As this new ACCC report observes, “regulatory scrutiny of the activities of data brokers or data firms in Australia has previously been limited, compared to some other jurisdictions.”

There’s a lot covered in the report, but one absolute screaming red flag is the way that the real estate sector is hoovering up data and then selling it on it to whoever they want.

In the case of the rental sector, the report highlights the huge imbalance of power where renters - often desperate to keep a roof over their head - are forced to hand over any data demanded by their potential real estate agent.

I’m sure every industry contains a mixture of competent and thoughtful professionals, and useless, lazy, dodgy ones. In my experience, I can’t think of another industry where the proportion of the latter is any higher than in real estate. One of the best things abut owning a home is no longer needing to be a supplicant to agents who don’t display basic competence or courtesy.

This sets up a time bomb in a sector which has far more access than most to sensitive consumer data like driving licences and other IDs, along with employment and rental history. I’m surprised there has not already been a bigger data disaster.

Yet as the report points out, would-be renters have little choice but to share their data. The rental crisis means they have no power.

The report highlights the rise of “RentTech” platforms used to make real estate agents’ lives easier in the application process.

According to the ACCC report: “Digital Rights Watch notes many renters feel they have no choice but to comply with whatever is asked of them, out of fear of being passed up for another applicant.

“In an April 2023 survey by Choice, 41% of renters noted they had been pressured to use a RentTech platform. This is likely exacerbated by the recent demand and increased competition for finite rental properties in many parts of Australia.”

The report adds “All this means that consumers are unlikely to have the opportunity to exercise choice or meaningful control over their data. This may be particularly problematic when consumers are required to provide personal information or other data on themselves to access important services, such as applying for a rental property or seeking quotes for services such as insurance.

“In practice, it is difficult for consumers to understand or control what happens to such data once it has been collected.“

Of all the professions, is real estate the one to trust to guard sensitive data? As the report puts it: “Given the large amounts of data collected across the economy, data breaches and misuse of data can have significant impacts on individuals. Such incidents can also damage the very businesses that are collecting and using the data. This all has the potential to affect trust in the overall economy.”

The power imbalance goes further. Potential tenants are being forced to take personality tests, including on the 10ant tenant assessment page.

The report says: “The ACCC is aware that some rental application processes may also require prospective tenants to undertake a personality assessment. For example, 10antprofiles advertises a personality assessment product that can be embedded via a link or code directly into the online application process.

“Applicants then complete the questionnaire, and 10antprofiles provides a report on tenant safety and risk. The 10antprofiles website notes that ‘applicant responses are indexed against our proprietary database of tenancy risk indicators’ and responses can be used to ‘predict future tenant behaviour’.”

As the report observes, mildly: “It is not clear to the ACCC how the collection of this type of consumer data is necessary for the purpose of considering a rental application. However, the ACCC notes that if requested as part of the application process, many consumers may feel they may have little choice but to comply in order to be considered for a property.”

That’s pretty dystopian.

And guess what? Those platforms have written into their terms and conditions that they can explit the tenants further by reselling that data to whichever rando they’re in business with.

As the report explains: The ACCC has observed that the privacy policies of some RentTech platforms facilitate the collection, use and sharing of consumer data with unidentified third parties. For example, analysis of the privacy policies of 2 RentTech platforms used in Australia identified that both facilitate the sharing of consumer data with unidentified third parties.

“One privacy policy examined states ‘You acknowledge and agree that your use of our products and services and your provision of your personal information to us, constitutes your consent, and 'opting-in', to us, or any third parties to whom we provide your personal information… [emphasis added] and ‘we may share your personal information with other third parties [emphasis added] (including any third parties you may interact with using our services) so that they can contact you directly about their goods or services, or other offers or promotions.”

The problem here is the lack of choice. If they want to find somewhere to live, the renter has to go along with it.

As the ACCC report says: “Consequently, consumers are unable to exercise choice or meaningful control over their data. This is particularly problematic when consumers are required to use a data-related product to access an important service, such as when applying for a rental property or seeking quotes for services such as insurance.”

The authors of this ACCC report have sent up a giant distress flare flagging the problem. Is anyone in government going to act on it?