The Big Short, the Big Steal and the Big AI Bubble

Welcome to Best of the Week, written this morning in peaceful Evandale, Tasmania. You’d never have thought we were in the midst of wild winds and power outages just 24 hours ago.

Today: Lessons from the Big Short. And investors cool on the SCA-SWM merger

It’s your last chance to sign up to a paid membership of Unmade and lock in all of the current benefits. Later this month, we’re going to stop accepting new paying members of Unmade. Instead we’ll be offering membership of an expanded Mumbrella Pro as we bring the two brands closer together.

All Unmade membership perks will be carried across, including complimentary tickets to REmade, Unlock and Compass for our annual paying members. These won’t be available to anyone else as part of the new Mumbrella Pro membership.

Your paid membership also includes exclusive analysis and access to our content archive, which goes behind the paywall six weeks after publication.

Upgrade today.

From the Big Short to the Big Steal

Back in 2007 I knew even less about economics than I do now. But I did read the weekly print edition of The Economist.

I’m not entirely sure why I remember it so vividly, but I recall the publication going on and on about subprime mortgages for many months. Yet however much it wrote about what later became the subprime mortgage crisis, there never seemed to be any real world impact. Until suddenly it did.

In the few weeks between my resigning as editor of B&T and starting Mumbrella in late 2008, the collapsing housing bubble took down Lehman Brothers, pushed the US into a recession and kicked off the Global Financial Crisis.

Finally the subprime mortgage crisis rippled into the real-world economy, and advertising-funded media was never quite the same again. It was quite a time to be starting a business.

The build-up to the subprime mortgage crisis was brilliantly covered in Michael Lewis’s book The Big Short.

This week, News Corp’s executive chairman Michael Miller gave an address at the Melbourne Press Club entitled The Big Steal.

Rather than the impact of AI on the wider economy, Miller’s focus was on the potential impact of changing Australia’s copyright laws to make it easier for AI products to scrape local content without paying for it. The so-called TDM, or text and data mining, exemption is a thought bubble from Australia’s Productivity Commission after what must have been effective lobbying by the Tech Council of Australia.

We covered Miller’s speech on Wednesday:

Miller’s speech became all the more timely with Google’s announcement the same day that it is rolling out AI Mode in Australia

A demo video created an example that scraped information from 32 different sites to create a walking tour of Melbourne, along with recommendations for where to eat and drink along the way.

Most of the links provided prominently appear to be to Google Maps reviews of the relevant businesses. For marketers, optimising for AI search is a necessity.

Missing from the video demo are paid ads, although Google revealed those are being tested, with a launch date in Australia yet to be revealed.

I wonder how much of the advice for that walking tour was underpinned by expertise provided by the likes of, say, Time Out, or Concrete Playground, who seem unlikely to get a user click out of the exercise.

Not that Google admitted that, claiming in its post: “When people click from search result pages with AI Overviews, these clicks are higher quality for websites, meaning that users are more likely to spend more time on the sites they visit.”

I suspect that if might be a better word than when.

But AI Mode is merely this week’s development against a much bigger economic backdrop.

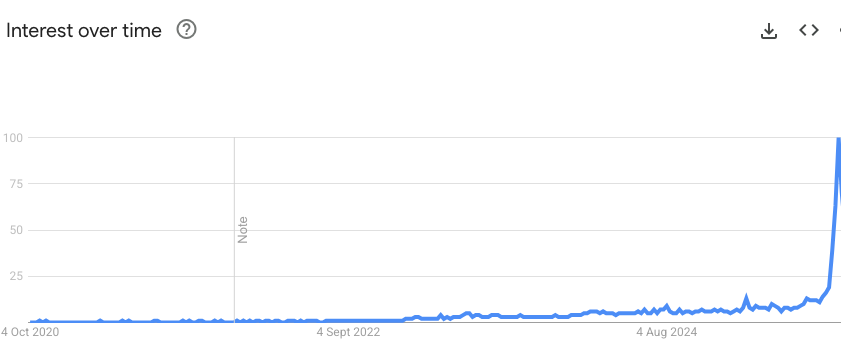

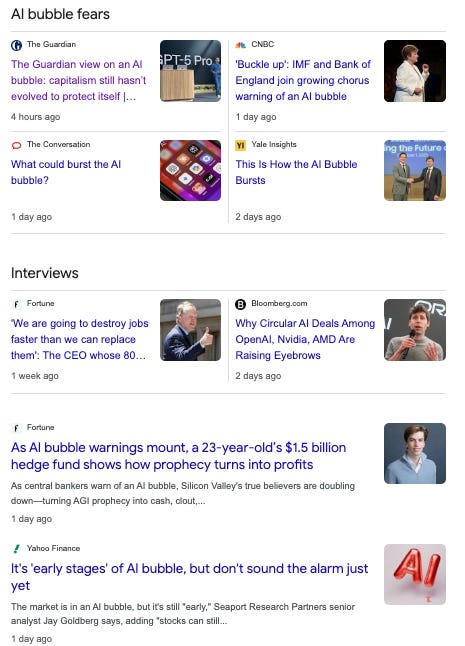

The increasing use of the phrase “AI bubble” reminds me of the way “subprime” started in the background, and then suddenly moved to the foreground.

In the space of a few weeks, economists have gone from asking whether we are in an AI bubble, to asking when it will burst.

And the coverage of the AI bubble has started to arrive in the mainstream.

That’s all reminiscent of another bubble - the dotcom boom then became the dot bomb when the first internet bubble burst in 2000.

This time the AI bubble is driven by layers of exposure which are increasingly leaking into the real world. The dollars pouring into chip manufacturers, data centres, startups and power generation are not just coming from venture capital, but from super funds. And the high valuations have driven up the entire stock market.

What both the dot bomb and the GFC had in common was the disproportionately bad impact on the media world when the bubbles burst, taking the rest of the economy with them. Advertising is always the first thing to be switched off by marketers

Messy as the coming months (and years) may be, there is also something of a case for optimism. Looking back at the dotcom boom, the internet economy emerged, built on the lost dollars of the investors.

Similarly, when the AI bubble bursts, the AI will still exist, and the new media and marketing world will be built upon it.

But before then we face some truly messy months ahead.

SCA-SWM valuation cools

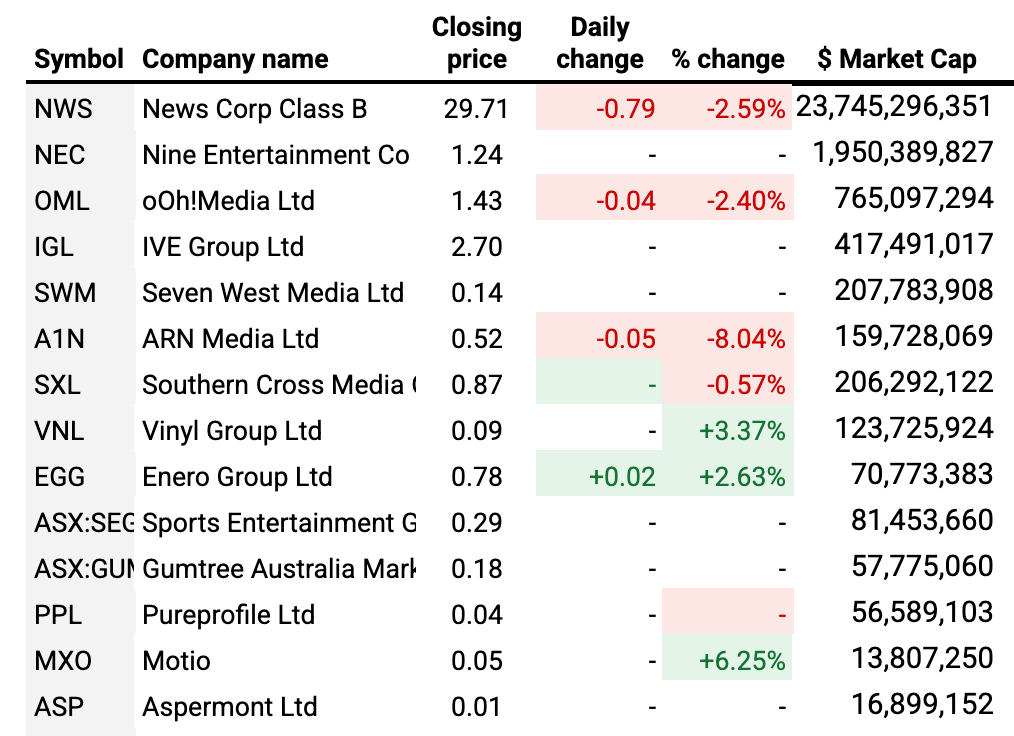

The combined market capitalisations of Southern Cross Austereo and Seven West Media yesterday fell below the level they were at a fortnight ago when their merger was announced.

The two companies now have a combined market cap of $414.1m. The night before the announcement they were a total of $415.8m.

ARN Media, which had been a beneficiary of consolidation mania, also took a big hit yesterday, with its share price dropping by 8% to a market cap of $159.7m.

Outdoor advertising company Ooh Media also had a bad day, losing 2.4% yesterday.

The Unmade Index ended the day narrowly in positive territory, up by 0.22% on 481.4 points.

More from Mumbrella…

ABC reveals plan to share regional content beyond emergency broadcasts

Justin Drape moves away from Exceptional Alien, starts new practice

Time to leave you to your Saturday.

If you’d like to hear a little more from me, last night’s episode of MediaLand, on ABC Radio National, is now available as a podcast. Our guest was Mark Humphries, as we discussed the fascinating rise and fall of Christopher Skase.

We’ll be back with more next week.

Have a great weekend.

Toodlepip…

Tim Burrowes

Publisher - Unmade + Mumbrella

tim@unmade.media