Southern Cross Austereo has had its worst ever start to a financial year. Can Listnr change the trajectory?; And a bad day for Enero

Welcome to a Friday edition of Unmade, during one of the busiest weeks of results season. Yesterday, Southern Cross Austereo, Enero and Domain all updated the market. As you’ll read below, the long term profit trend for SCA is downwards, while the outlook for Enero spooked investors.

The team from Unmade is also behind RE:Made - Retail Media Unmade. Taking place in just a fortnight from now, REMade is the retail media sector’s first Australian conference. View the program here.

How Southern Cross Austereo’s profits have fallen for the last dozen years

As somebody who thinks more slowly than they speak, I need to write things down to find out what I really think. And when I don’t know where to begin, I build a graph.

That particularly helps when you’re trying to work out the long term story of a business. The nature of the financial world is to compare things to the previous year. Sometimes that can hide the trend.

Take yesterday’s half year update from Southern Cross Austereo.

Revenue actually went up a little, from $259.8m to $260.1m.

But the EBITDA (earnings before interest, taxation, depreciation and amortisation) profits for SCA were down somewhat - falling from $48.2m to $43.1m. There was a reasonable explanation - investment in streaming platform Listnr.

It all sounds fair enough. Unless you draw a graph.

Below is a chart of the revenue and profits for SCA for the first six months of each financial year since the company was created when Southern Cross Media took over Austereo in 2011.

The red line - which shows the falling profits throughout that time - tells a story. Back in the 2012 financial year profits for the first half were $123m; yesterday’s number was a third of that.

The green bars shows revenue, which has also declined albeit not as fast.

Not labelled on the graph are the key moments on the timeline - 2014, when Kyle Sandilands and Jackie Henderson defected from SCA’s 2DayFM to launch ARN’s KiisFM; the slow decline in ratings for Ten which has been SCA’s main regional TV affiliate deal during the decade; the replacement of CEO Rhys Holleran by Grant Blackley in 2015; the boost to the bottom line of Job Keeper in the 2021 financial year.

Also absent from the timeline are the debt levels that were faced by the company as a result of the merger process. By the time Blackley took over from Holleran, they had blown out to a near-crippling $472.6m.

Arguably the February 2016 deal done by the newly arrived Blackley to sell future airtime to The Australian Traffic Network for $207m staved off administration.

The current net debt level revealed in the latest numbers is a more manageable $102m.

In 2023, SCA is a company moving at three different speeds - in TV, radio and streaming.

In television, SCA owns regional licences. The main affiliation deal is to take Ten’s content in exchange for a percentage of local ad revenue. There’s a similar, smaller deal with Seven in other parts of the country.

The current Ten deal has just over three months to run, while Seven has another year. After the results release, I got a few minutes with Blackley on the phone yesterday. He confirmed that talks with Ten’s owner Paramount are already under way on renewal terms.

The word Blackley used to describe the relationship was “co-dependents”. Seven owns Prime and Nine is intertwined with WIN, so Ten and SCA are stuck with each other.

SCA had tried to sell the TV licences but couldn’t get the price it wanted. Paramount would still seem to be the only logical buyer, but doesn’t want to overpay.

In the meantime though, the TV operation provides SCA with a profit margin of 24%. The audio part of the business is delivering 20%.

One day the TV business will be worth nothing. When all content is streamed, the regional affiliates will no longer get a slice of the revenue. The broadcasting licences will merely be worth whatever the government is willing to pay to get the bandwidth back to auction off to telcos instead.

So SCA’s future lies in audio, and particularly streaming. One reason profits were down despite revenue staying flat is because the company is still aggressively investing in Listnr which is not yet profitable. Increasingly, the radio operation and Listnr are becoming two businesses.

Last week, media agency heavyweight Seb Rennie joined SCA as executive head of Listnr’s commercial operation. Unusually for such an announcement, reporting lines were not disclosed at the time. Blackley said yesterday that Rennie will report in to chief operating officer John Kelly, rather than chief sales officer Brian Gallagher, who gets a dotted line. That’s another sign that SCA is increasingly becoming two (or even three) seperate businesses.

Off the table for now, incidentally, seems to be the idea floated by Blackley last year of taking Listnr overseas. At the time, he said he would be taking that thought to the board’s annual two-day strategy session in October. When I asked about it yesterday it remained a long term possibility, but getting it right in Australia is all that is on the table for now. (In other words, the board said no.)

That graph hides another factor, by the way. The company still pays its shareholders decent dividends. Yesterday it announced 4.6c per share. With a share price of just over a dollar, that’s a better return than most banks give right now. It’s certainly better than Seven West Media’s current zero.

Not every business, or part of a business, can be run for growth. Listnr is the growth bet. TV and radio are the cash cows to be milked by SCA for as long as possible.

It’s not particularly sexy, but SCA looks set for many years of slow, profitable decline.

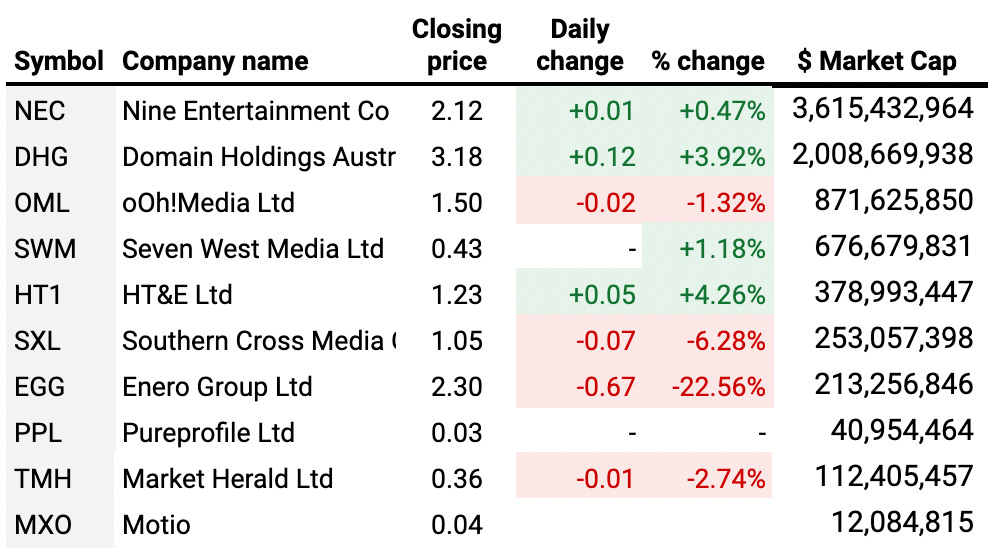

Unmade Index: Enero outlook set warning lights flashing for the agency sector

The most notable movement on The Unmade Index yesterday was Enero’s precipitous 22.56% fall in market capitalisation.

The number is among the worst one-day drops the company’s stock has seen since its dark days when it was circling the drain as Photon Group 15 year ago.

The fall was most remarkable because it came on a day when the company posted decent numbers on its performance for the first half of the financial year so far. Revenue for the half was up by 39% to $130m. Profit was also up 39%, to $44m.

That excellent result had already been factored into Enero’s share price though. The fall was triggered by the picture offered by CEO Brent Scrimshaw of the outlook going forward.

For anyone working in communications agencies, Enero is the only ASX indicator of what’s going on in that part of the industry. The rest of The Unmade Index are media companies rather than agency groups.

The jewel in the crown for Enero is the Sydney headquartered creative agency BMF, but it employs 750 staff across 11 countries.

The trading update will not be the last one to use the phrase “macroeconomic headwinds” this year.

On The Unmade Index, Enero was the worst performer, with the overall index falling 0.32% yestereday.

Meanwhile, SCA fell by 6.28 on the back of its update.

Time to leave you to your Friday. I’ll be back with Best of the Week tomorrow. I’ve been thinking about the credibility (or otherwise) of consultancies’ claims to be better at keeping client secrets than agencies on the back of the PWC tax advice scandal.

Have a great day.

Toodlepip

Tim Burrowes

Publisher - Unmade

Great read Tim...incredible to see the markets maul Enero on great first half results. "Macroeconomic headwinds" are powerful indeed.

Really interesting analysis. Good job!