Search is still sexy: Why sponsored products remain retail media’s powerhouse

Welcome to a retail media-focused edition from Unmade

In this edition, Colin Lewis argues that search may not be the shiniest object in retail media, but it remains the engine driving most of the money. We also include details of how you can download our 2025 retail media trends report, based on the many insights shared at last month’s REmade conference.

And further down, ARN Media ended the week as the Unmade Index’s biggest loser.

It’s your last chance to sign up to a paid membership of Unmade and lock in all of the current benefits. Next week, we’re going to stop accepting new paying members of Unmade. Instead we’ll be offering membership of an expanded Mumbrella Pro as we bring the two brands closer together.

All Unmade membership perks will be carried across, including complimentary tickets to Unlock and Compass for our annual paying members. These won’t be available to anyone else as part of the new Mumbrella Pro membership.

Your paid membership also includes exclusive analysis and access to our content archive, which goes behind the paywall six weeks after publication.

Upgrade today, or miss out.

Don’t believe (all) the AI hype: search still drives the lion’s share of retail media’s billions

In this guest post, REmade columnist Colin Lewis argues that while AI-driven overviews are changing how shoppers search, the humble sponsored product ad remains retail media’s most powerful - and profitable - format.

The retail media conversation sometimes forgets the important ad unit of all: search.

The advertising unit called ‘sponsored product’ or ‘sponsored search’ is among the most important advertising tools ever invented. Search is still the core driver of retailer ad revenue and is considered premium inventory.

Let’s look at the evidence:

Sponsored search is the most important revenue driver for most retail media networks.

Amazon Ads was at US$56bn in 2024. 2025 is projected to exceed $60bn in 2025. What is 80% of this revenue base? Sponsored products.

Not only is search advertising still 80% of all Amazon Advertising revenue, but it is also still 57% of all Google Advertising revenue.

Napkin maths says that sponsored products is a US$40bn business for Amazon. US$144bn is one estimate of linear TV advertising market size. In other words, sponsored search as ONE advertising unit, on one channel (Amazon) is a fifth of the (shrinking) linear TV revenues.

Digital commerce is the fastest-growing part of retailing, and digital commerce is driven by a search bar.

New technologies are coming through that are changing search.

Google’s AI-powered Overviews and AI Mode are also starting to reframe how consumers find and evaluate products: surfacing summarised results, recommendations and reviews in a conversational format rather than the familiar list of blue links.

This means discovery is becoming more dynamic, but it also means traditional, keyword-driven search results still underpin the entire ecosystem. Without those structured listings and paid placements, the AI layers have nothing to build on.

Search is just getting started, but it’s changing fast

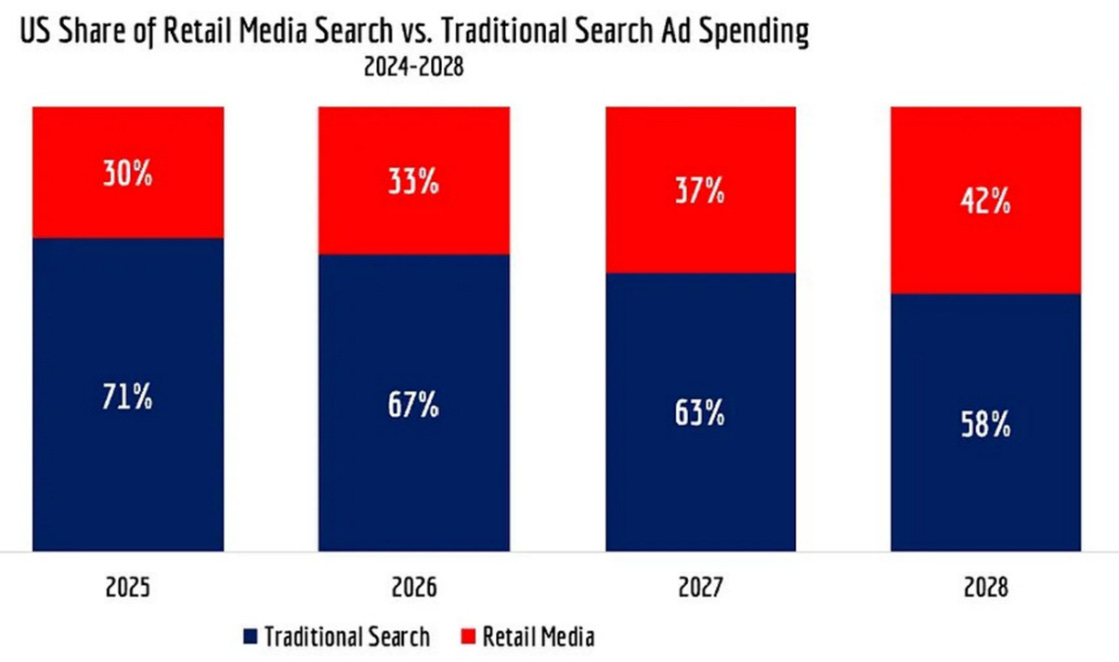

Retail Media search ad revenue is set to surpass 40% as a percentage of overall search revenue in the world, according to research carried out by Andrew Lipsman of Media, Ads and Commerce.

However, retail media search does not always deliver for shoppers.

The way customers search is changing

The way people use search bars is changing. Instead of typing a few basic keywords, shoppers are increasingly entering full, conversational queries that reflect how they might speak to a real person. Rather than treating search like a catalogue lookup, shoppers now interact as though they’re asking a shop assistant to help them find the right product.

At this month’s Retail Media X conference in London, the conversation was about rethinking sponsored product from scratch. Hugo Danielian of Mirakl Ads says their data indicates that there is increasing complexity of search queries, which often include longer, more conversational phrases due to consumer familiarity with tools like ChatGPT.

As a result, a new type of search technology called “vector search” is being used to help to better understand user intent and match fuzzy queries with relevant products, even without exact keyword matches.

Traditional search typically uses keyword search, whereas vector search is a search technique used to find similar items or data points using numerical representations of words, documents, images or videos. This enables much faster search results and faster processing by machine learning models and AI applications.

This improves the relevance of the answers given to the shopper, which in turn drives click-through rates – and, in turn, retail media networks’ revenues.

Even as AI-generated overviews begin to evolve, retailers should be cautious not to overcorrect.

Generative layers can summarise, but they don’t replace the transactional precision of search. Sponsored product ads, keyword relevance and buying intent signals still form the commercial spine of discovery. In short: AI is the garnish; search still remains the main course.

The challenge is that most retailers see search as a ‘one-and-done’ exercise - I have installed search technology, so now what is the next ad unit to deliver the next phase of growth?

What should retailers do?

To meet this shift, retailers must consider search in a new light – one that supports both keyword-based and natural-language inputs while still delivering accurate results for traditional queries.

Shoppers often use need-based queries when filling their carts. Instead of just typing a product name, they might enter: “gluten-free snacks for kids”, “post-gym protein drinks” or “treats for movie night”.

This change brings two challenges for retailers:

helping customers find what they’re looking for

enabling them to discover new products.

Retailers have to meet this twin challenge by supporting both keyword-based and natural-language inputs while still delivering accurate results for traditional queries.

A hidden challenge is that Google is the benchmark for search, and their resources dwarf all retailers. For example, although Google search advertising is 25 years old, almost 25 updates were announced in the last 18 months alone. And Google is upping its game on search too: it claims that “even on the most nuanced and complex questions, we will be able to predict what the searcher might need next and deliver relevant ads in new moments and contexts that didn’t exist before.”

Much of this evolution is tied to the rollout of Search Generative Experience and AI Overviews, which blend conversational AI with classic search infrastructure, indicating that even Google’s AI future is still built on the bedrock of search advertising.

Where Google leads, retailers should follow.

TL;DR – What should retail media networks do?

Recognise that search matters: Sponsored search is the single biggest advertising channel when you combine Amazon Advertising search revenues

Search is changing: Shoppers often use need-based queries when filling their baskets. Existing approaches to search on retailer websites need to be updated.

Search tech is changing: Retail media networks should assess search updates. New search technologies are coming through that deliver new algorithms with better targeting and relevance which in turn increases CTR and conversions. Are you—or your search-tech vendor—updating your search capabilities?

The REmade Retail Media Trend Report reveals how brands and retailers are preparing for a data-driven, AI-powered, full-funnel future.

Insights drawn from the 2025 REmade Retail Media conference as well as other sources, this report breaks down the five biggest trends of retail media. Produced in conjunction with Coles360, download your free copy now.

The Women in Retail Media Collective brings together women working across retail media to connect, collaborate, and champion each other’s success in this rapidly evolving industry. Launched with its first event at REmade, which drew an incredible response and full room of industry leaders, the collective is already proving the power of community in shaping the future of retail media.

Register for the Australian chapter of WRMC here.

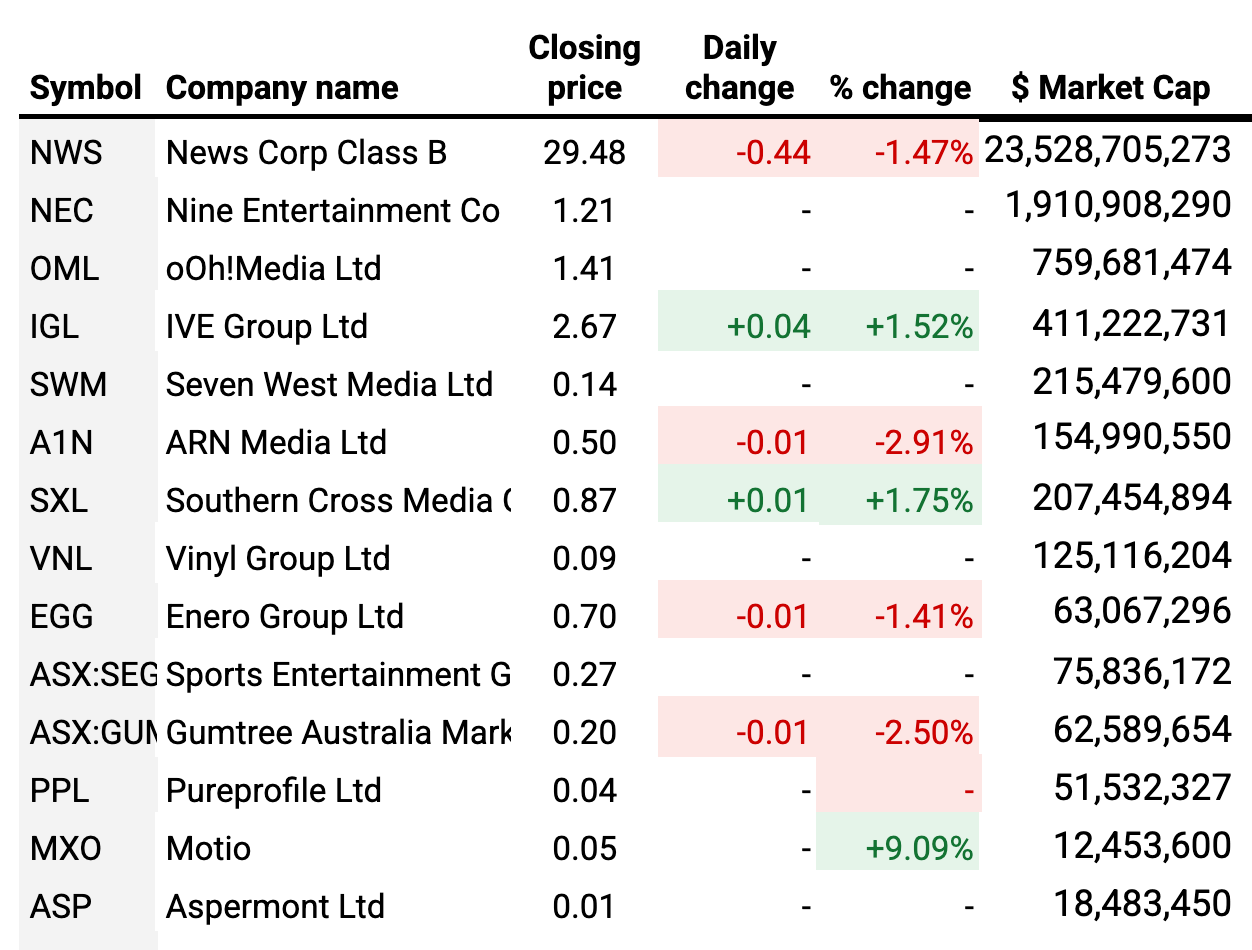

ARN Media ends the week on a downer

ARN Media ended the week on a downbeat note, losing 2.9% today to land on a market capitalisation of $155m. Meanwhile rival audio stock Southern Cross Austereo improved by 1.8% to close on a $207m valuation.

In a day that saw no movement at all from half of the media and marketing stocks on the ASX, the Unmade Index closed up fractionally on 474.5 points, up 0.9 on Thursday.

More from Mumbrella…

‘I have an order of extinction’: Mat Baxter on why the holdcos won’t be around in 5 years

Crime reporter’s journey from smoke-filled newsrooms to being ‘the guy from Tiktok’

Opinion: Brand awareness shouldn’t be mistaken for brand success

Time to leave you to your evening.

We’ll be back in the morning with Best of the Week.

Have a great night

Toodlepip…

Tim Burrowes

Publisher - Unmade + Mumbrella

tim@unmade.media