REmade topics revealed; Here come the REmade Awards; Teresa Aprile on the instore revival

Welcome to the latest edition of the REmade newsletter, sister publication to our REmade conference, where the retail media community comes together.

If you’re not already subscribed to the REmade newsletter and have been forwarded this by someone else, make sure you don’t miss the next one by adjusting your notification settings via this link.

Each edition of REmade includes a monthly Q&A with a key player in the retail media space. This month’s guest is Brandcrush co-founder Teresa Aprile. We also feature our regular column from global retail media evangelist Colin Lewis; this month on the trajectory of retail media.

If you have a friend or colleague who may be interested in reading the REmade newsletter, please tell them about us.

REmade is where Australia’s retail media community comes together. Tickets are now on sale for the next REmade conference on Wednesday October 11. Book before August 14 and save.

Unveiled - the agenda for our next Unmade conference

Cat McGinn, curator of REmade, writes:

Less than a year on from the first REmade conference, there have been significant changes and shifts in the retail media space, and we’re seeing greater sophistication in client work and case studies.

Developed in consultation with our advisory panel, our ambition is to deliver another program at the cutting edge of the sector, and make sure we’re staying ahead of where the market is moving to keep our content relevant, useful and grounded in real-world best practice.

We’re still accepting speaker submissions - I’m particularly interested in talking to those with something to say around the following topics:

The REmade draft agenda:

The connected consumer: centring the customer in the retail media ecosystem

Collaboration - what really goes on behind the scenes in creating the relationship and ecosystems to deliver a connected experience for retailers, brands and customers?

Marketplaces: Amazon and beyond

Measurement + standardisation

The return of the retail media leadership Q&A panel

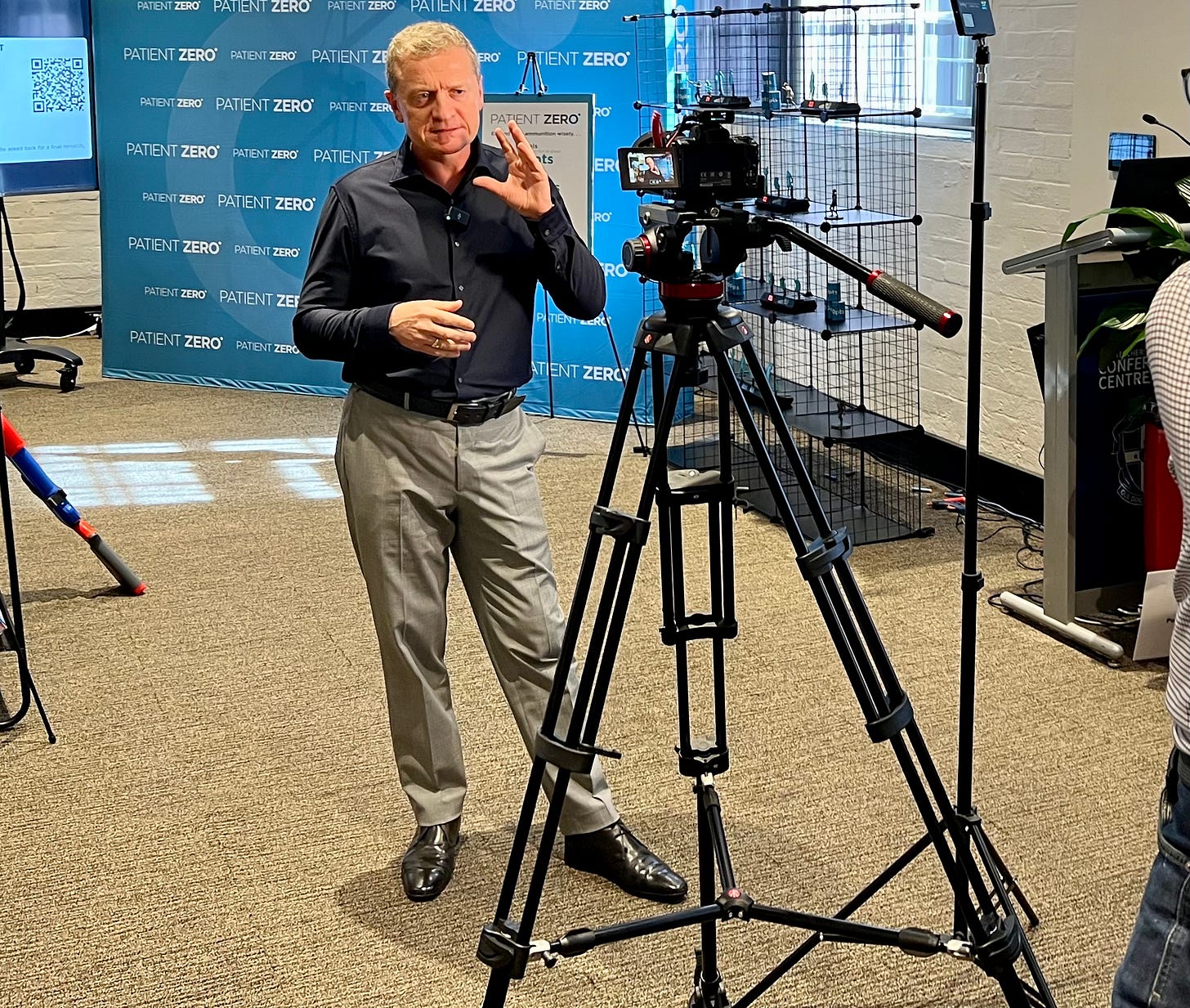

I’m also delighted to announce that the UK-based Colin Lewis, who was one of the highlights of the first REmade, will be returning to talk about the evolution of marketplaces, and what the Australian should expect based on global trends

Early bird tickets with a saving of 20% on full price are on sale for the next fortnight, and group discounts are available. As always, Unmade’s paying members get an extra discount on top of that 20%, so why not subscribe today?

The REmade Retail Media Awards

And while I’m announcing things, I’m also delighted to reveal the REmade Retail Media Awards. As part of our contribution to supporting and growing this community, we’re launching the awards program to celebrate and showcase best practice in the retail media sector, and to highlight the individuals who are making an impact.

In the first year, the awards will be modest in scope, covering four or five categories, with the shortlist announced at the REmade conference.

Further details will follow next week.

If you’d like to get in touch about speaking opportunities at the conference; to be considered for our awards jury; or to be connected to our sponsorship team, feel free to email me at cat@unmade.media.

Q&A: Brandcrushing it with Teresa Aprile

What has changed in retail media since we saw you at REmade in March?

It has continued to grow at a fast pace. We have seen retailers re-organise themselves to maximise the opportunity, and we are also seeing new opportunities arise that will continue to catapult retail media upwards.

Particularly, we are finally seeing in-store being given the attention it deserves. Physical stores reach sizeable audiences that are on average 70% larger than digital audiences for major brick-and-mortar retailers and technology has made monetising and measuring these audiences much easier.

And big changes for Brandcrush, being acquired by Criteo - how is that progressing?

There are fantastic synergies between our two platforms which solve for the key challenges and needs retailers and brands have for a unified commerce media solution.

Despite retailers’ varying in terms of their retail media maturity there is still a consistent need to support scale and to do that retailers need a solution that does this - that unifies all their media assets into one experience; facilitates all demand from their trade direct bookings with their suppliers to the agency and brand direct demand and a solution that works to simplify the complexity in the retailers’ media ecosystem.

We recognise that no one retailer is the same - our solutions can work flexibly to serve them so it’s been exciting to have this depth and support to meet our partners where they are and where they need to go.

What do you see as being the next focus area for the industry?

To me there are three key opportunities that stand out as transformative game-changers for brands and retailers and they are the instore revival; audience extension and measurement.

As onsite channels intensify, in-store is emerging as an exciting frontier to drive differentiation and conversion for brands and retailers and growth will depend on how fast they can unlock new in-store marketing tactics. Retailers re-energizing their in-store footprints will not only offer brands and agencies better media performance, but will attract bigger marketing budgets, and most importantly, drive shopper value.

Sophisticated retailers are sitting on a goldmine of powerful insights within their first-party data, which should inform media buys beyond their owned assets and capture the power of new partner channels like social, CTV and DooH. As we are well on the way to a cookie-less future, the use of retailers’ consumer data in the broader off-site ecosystem supports a greater opportunity to understand omnichannel shoppers’ motivations and anticipate their needs. It is an effective and scalable tool to help stores and brands reach the right shoppers, in the right moment, with the right message.

Data can only be powerful if you can harness it. It’s challenging for brands and retailers, navigating retail media performance across the full ecosystem. The clearer the direction on why and where best to place your precious media dollars, the greater the retailer influence on marketing budgets. Shopper data and measurement will continue to be a critical path forward to growing retail media globally.

What recent work accomplishment are you most proud of? And what are you most excited about in terms of future plans, innovation at work etc.?

I am very proud of what our team has achieved to date across the entire technology solution for our retail partners. We are here to empower retailers to own their ecosystem and we continue to do that with every feature development integration and partnership that drives transparency, automation and monetisation opportunities.

Our focus remains to deliver a unified omnichannel platform experience across online and offline commerce media for our partners, that will benefit the entire ecosystem with new growth opportunities.

How are you feeling about the speed of AI transformation, and how do you see AI impacting retail media?

AI is only as good as the data that it learns from. For AI to be truly transformative, you need the right data architecture in place to translate millions of points of data into predictive intelligence. Within the Criteo group, AI is really at the core of what they are doing so it is an exciting time to be able to leverage this intelligence and see how it translates for our clients.

Within retail media AI that drives automation and intelligence across media and audience selection, media management and measurement will give retailers, agencies and brands a competitive edge and more time on strategy and creative. I truly believe that AI will help to drive greater marketing dollars towards retail media when adopted effectively.

What recent book, TV show, film or idea changed the way you saw the world, in a large or small way?

Atomic Habits by James Clear is one of those books where his lessons are so logical but ones that we need to be reminded of. Since reading it I often listen to it on Audible. I also subscribe to his Thursday newsletter: three ideas from James, two quotes from others and one question for you. They help you stop, reflect and often share the pearls of wisdom. Recently he shared the following which resonated with me:

We want solutions, but what we really need are attitudes. You don’t need abs, but rather an attitude of training. You don’t need the answer, but rather an attitude of curiosity. You don’t need an easier life, but rather an attitude of perseverance. Attitude precedes outcome.”

I think this is so relevant when we consider business transformation in retail media. It requires more than a tech solution, it requires an attitude shift.

We welcome suggestions for future Q&A guests - cat@unmade.media

A Potted History of Retail Media

The rise (and rise) of retail media is just beginning, writes marketer and global retail media specialist Colin Lewis in his regular column for RE:Made.

Andrew Lipsman, principal analyst at Insider Intelligence, is one of the best analysts and writers about Retail Media. He recently gave a potted history of Retail Media that gives a great context for the fastest-growing digital advertising channel of all time.

Retail media has achieved in five years what search ads (i.e., mostly Google AdWords) took 14 years to do. Adoption has been rapid; the tools are getting more mature and the market is ready.

Where did it all start?

Amazon has built a multi-billion-dollar ad business over the last ten years. As Andrew Lipsman points out: “We began to see Procter & Gamble display ads on Walmart.com. At the time, we called them digital endcaps, and we thought they served a similar function as they raised brand awareness. It's been driven by search, analogous to Google. It's even better than search, because people are already in the digital store.”

However, outside a niche part of the media world, and sellers on Amazon, most marketers ignored these networks. Among retailers, the teams tend to work in their siloes with the trade marketing team bundling in digital real estate among existing agreements and ‘giving’ away much of the valuable digital real estate.

People really started to pay attention when Amazon showed the number that had previously been hidden under the "other" line, and broke this line-item figure as ad revenue.

The industry was stunned. People knew that Walmart had been getting serious about advertising networks and that Target had Roundel, and vendors like Criteo and Citrus were starting to get serious recognition.

It became clear that Amazon Advertising is a huge advertising business. It went from $32bn in 2021, to $38bn in 2022 and Insider Intelligence estimates it will be $45 billion in 2023.

Why did it take other retailers so long to get going?

First of all, the tools and technology were not really there. AdTech for retailers such as Citrus really only came on stream around 2016/2017. Criteo was known for its retargeting business and became involved in Retail Media only through a stream of aggressive acquisitions.

However, there are other reasons, as Lipsman points out: “Advertising and AdTech is not a core competency. As much as they wanted to compete with Amazon, they didn't have the skills, talent or technical capacity. It was a slow start, even for players like Walmart. Many others are following suit now. Retailers have a lot of online traffic, and it is relatively easy to monetize. And I believe that retail media is in its early innings. It's about to get interesting.”

Lipsman believes that we are barely started in Retail media. Here’s why:

Up the Funnel: Retail media is moving up the funnel, particularly into streaming TV. Amazon is doing a lot in streaming TV which is a game changer for how we all think about TV advertising.

Attribution: In-store attribution data completes the return-on-ad-spending picture for brands. In-store audiences can be reached with high-quality, contextually relevant, brand-safe creative a the moment near the point of purchase. Instead of shelf-wobblers, these channels can use digital technologies to created personalised ads that can attributed to that store with promotions that are location specific – and can be sold as an individual advertising package.

The digitisation of in-store is possibly the most interesting. Digitisation of physical stores is a megatrend, there’s more digital signage entering stores and on different surfaces, between aisles, drop-down screens, smart carts, and cooler doors. Technology now exists to measure the impact of such propositions.

Once decent attribution measures are in place, these massive audiences – which are bigger than digital and TV and, in a brand, -safe environment, reaching people close to the point of purchase – will start appearing on media schedules.

What are the challenges with Retail media?

There are two important questions – one from the retailer’s side and one from the brand side:

Brands having to work with dozens of media networks, depending on traffic. Not a huge problem in Australia at the moment, but starting to be a strain for brands operating in the UK and US - it is resource intensive to work lots of platforms at all once. Still, things will shake out and probably won't be a game-changer for mid-tier retailers.

From the retailer’s side, there is the issue of judging customer experience online v the all-important question of ad load. More ads equal more revenue but poorer experiences for shoppers. This is a question every retailer needs to be asking. The main point to note here is that if the ads are relevant, then the consumer doesn't care.

We’ll be back with more soon. Please do get on touch.

Cat McGinn, Curator - REmade

cat@unmade.media