REmade Retail Media News: Collaboration and margin salvation

Collaboration supercedes competition; why retail media will boost margins more than AI; we reveal the second REmade conference program and our first REmade Awards

Welcome to the latest edition of the REmade newsletter, sister publication to our REmade conference, where the retail media community comes together.

If you’re not already subscribed to the REmade newsletter and have been forwarded this by someone else, make sure you don’t miss the next one by adjusting your notification settings via this link. Make sure you’ve clicked REmade - see below.

Each edition of REmade includes a monthly Q&A with a key player in the retail media space. This month’s guest is Mercato CEO Vanessa Robb. We also have a regular column from global retail media evangelist Colin Lewis; this month on how retail media is the only hope of boosting margins during grim economic times.

If you have a friend or colleague who may be interested in reading the REmade newsletter, please tell them about us.

REmade is where Australia’s retail media community comes together. Tickets are now on sale for the next REmade conference on Wednesday October 11. Secure your place now.

REdefining Retail Media

Cat McGinn, curator of REmade, writes:

We have announced the detailed program for the next edition of Unmade’s retail media conference REmade, which takes place in Sydney on October 11.

The program has been developed to offer insight and relevance to all marketers, no matter whether they are in the early stages of retail media transformation, or seeking to optimise their capabilities. We’re delighted to have David Jones Amplify sharing the steps they have taken to begin their retail media transformation, as well as Warehouse Group explaining the approaches being employed as they move through the retail media maturity curve.

The agenda also aims to broaden the scope of understanding of retail media networks beyond the grocery category, with speakers from a diverse range of retail media networks on the program.

The lineup features industry-leading speakers who have been at the forefront of retail media innovation. They'll delve into its potential, sharing success stories, the obstacles and challenges overcome in building a successful retail media network, best practices, and forecasting trends.

Our first REmade event brought the retail media community together. It’s an incredible opportunity to network, exchange ideas, and discover collaborative possibilities.

Lifting all boats - the REmade Awards

We’re also delighted to have launched our first awards, modest in scope for this first year but a strong signal of the elements we, and our advisory panel, believe are essential factors in delivering retail media success - collaboration and innovation. And recognising the individuals who are shaping and elevating the sector overall with Retail Media Leader and Retail Media Rising Star.

Find out more about the categories and criteria, and please pass on this information to anyone you know who is doing brilliant things in the space.

Q &A: Vanessa Robb, CEO, Mercato

In this edition we talk to Vanessa Robb, who founded Mercato in 2018 to deliver niche digital screen, automated marketing and data software solutions for retailers.

Since the last REMade conference, what has changed in retail media in Australia?

One thing that is becoming apparent is the extra attention around how data is collected.

What do you see as being the next focus area for the industry?

The increased correlation of data, consumer behaviour, media spend and real ROI. There is an increasing amount of independent, specialised and sophisticated platforms correlating spend and effectiveness in real time. We have recently partnered with Eyos in Indonesia to enhance and maximise the return on investment for advertising clients - primarily CGP clients. MSME (micro, small, and medium-sized enterprise) grocery retail is the largest grocery channel in Indonesia and is highly relevant for brand building, reaching urban and rural households every day with high frequency and loyal shoppers.

What do you see as being the next focus area for the industry?

The increased partnerships between software platforms to deliver greater transparency and accountability. An improvement in reporting and much greater prosecution around marketing results by advertisers and media agencies. I expect to see higher involvement and buy-in from media agencies as they increasingly realise how critical the retail media sector is in the context of overall media spends.

What recent work accomplishment are you most proud of? And what are you most excited about in terms of future plans?

Our imminent launch of a retail media network in Indonesia with a major telco partner. Being able to realise our software potential with deep data overlay at scale is super exciting in an emerging market with 290 million people.

How are you feeling about the speed of the AI transformation, and how do you see AI impacting retail media?

AI will become instrumental in developing and automating media content for publishing. We expect to increasingly see specialised emerging platforms capable of automating the development of visual content and testing results, creating huge efficiencies in the ecosystem. The speed and capability of AI appears to be faster than companies’ ability to engage with it in an effective way.

What idea changed the way you saw the world, in a large or small way?

An idea I’m seeing particularly in Asia is that collaboration of platforms and businesses supersedes the idea of competition. There’s a big movement towards partnerships - in our case, other software companies and global media agencies who see the need to serve customers better through specialisation and speed.

The real driver for retail media - it’s about the margins

In our regular column from Colin Lewis he explains the real attraction for retailers of owning a retail media network: the margins.

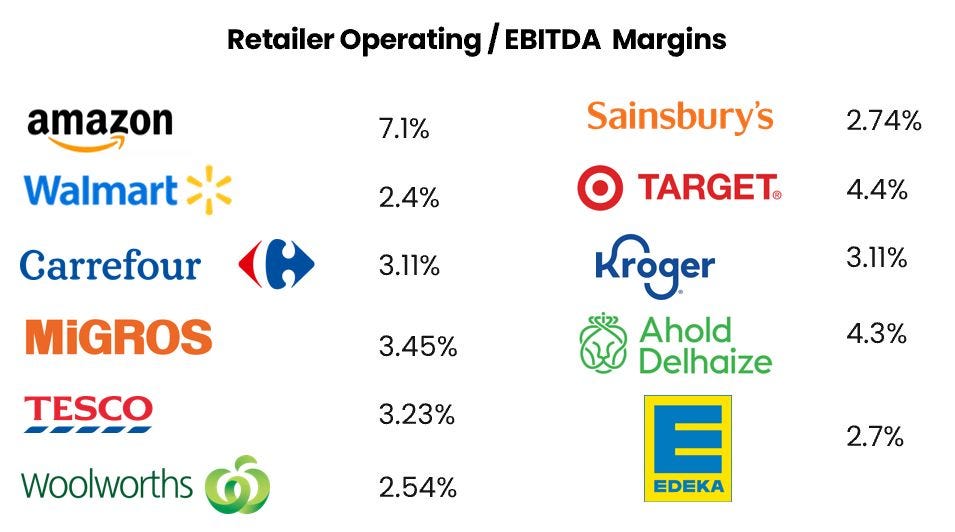

What are the operating margins of major grocery retailers around the world?

In a word, grim.

Yes, net EBITDA margins are not a perfect measure or sometimes comparable, but it is indicative. You can see that the majority barely get to 5% (with one exception!)

Retailers have always struggled with lower margins. But this has become a real problem due to the increased costs associated with eCommerce - pick/pack and delivery is NOT cheap.

Retailers have to find ways to offset eCommerce costs and increase their margins. Optimisation has been wrung out of every line of the logistics chains. Money for trade marketing has been chased for years. What has not happened? Using tech to monetise customer data to power advertising.

Retailers have few other choices:

Squeeze supplier trade money even more (tough work)

Charge customers more (not in recessionary times)

Spool up a retail media network to create more value for suppliers and capture more brand dollars that are currently going to other media players.

Walmart, Kroger and Target in the US have major initiatives underway with hundreds of millions of capital invested to automate order fulfilment and to optimise their store fleet to reduce the cost of delivery. The story is the same across Europe and Australia.

Number three is one of the options that has to be pursued. Retail media networks have to be embraced as they are the only option left on the table. Even optimisation through AI will add only a small uptick in margins.

This is also generating investor interest. International investment bank Goldman Sachs released a detailed piece of investor research in February 2021 called “The Merchant-Media model: A new era for retailers as ad platforms”. The piece pointed out:

“In their belated push into e-commerce, supermarkets and broadline retailers face significant investor concern over the rising cost to serve the customer. But we believe investors focused on this legitimate threat are overlooking a compensating upside – the growth of a new revenue stream from retailers’ own media businesses.

As retailers harness their engagement with the customer to offer targeted advertising and marketing platforms for others, the new “merchant-media” model presents a largely unappreciated offset to e-com costs, with reverberations (often negative) up the value chain and into CPG manufacturers and their legacy media providers.”

Decoding investor speak, this means ‘we want retailers to introduce retail media options as we don’t like the big costs of eCommerce’.

What else did the piece say? “Larger grocers are uniquely advantaged to capture the relatively new and growing media income stream, resulting in a competitive imbalance that is likely to see the large getting larger and the small fading away. The balance of power between the grocer and the vendor should shift in the retailer’s favour as a result. We expect the same dynamics to play out in Europe, with the UK grocers particularly well positioned.”

Decoding investor speak, this means “the rich get richer, and the mid-market retailers don’t stand a chance of setting up retail media networks.”

I would argue that is not going to pan out. Sure, the “big boys” have a head start, but don’t underestimate the value of the first-party data that a bunch of retailers who chose to come together would offer to the market.

More from Goldman Sachs: “The rise of retail media is poised to perpetuate what has been a persistent headwind to legacy media providers. And it may also become a headwind for established digital media providers as high return on invested capital alternatives to Facebook or Google emerge”

Decoding investor speak, this means “Google and Facebook are under threat”.

To summarise, Goldman believes that the fact that retail media can solve the following problems will fuel its continued rise:

Retail Media generates an incremental revenue stream that can help offset rising digital costs

For consumer packaged goods manufacturers, it allows them to influence their sales and market share on the digital shelf while improving the returns on their media investment

The investment community want retailers to set up Retail Media Networks. And what investors want, CEO retailers have to deliver.

The final word comes from Walmart CEO, Doug McMillon said: "I can't remember a business with the margin structure of the advertising business here at Walmart, and having 30% growth for the quarter was nice to have."

You can hear from Colin Lewis at REmade - Retail Media Unmade on October 11.

He will examine the evolution of marketplaces, their impact on multiple factors across eCommerce, from pricing to supply chain. Colin will also be drawing on his work with a host of US and European businesses, including Kroger, Walmart and Amazon, and sharing what the Australian market should expect, based on global trends.

Tickets are still available at remade.net.au.

The REmade newsletter will be back with another edition next month.