Investors still think Netflix subscribers are worth $1300 each. That's crazy

Welcome to a Friday update from Unmade. Today we explore new data on how Netflix is tracking globally, one year after announcing its new advertising tier, along with its implications for the wider streaming world.

Are you one of the select few? Unmade has 0.00011704% as many paying subscribers as Netflix. Signing up as a paying member today will help us could turn that number to 0.00011745%.

Not only will you get access to Unmade’s full archive, which goes behind the paywall after two months, but you’ll get the warm feeling of knowing you made 0.00000041 percentage points of a difference today.

This full post is for Unmade’s paying members only.

Is every Netflix subscriber really worth $1,300?

Tim Burrowes writes:

It must be so annoying for Netflix.

That one quarter exactly a year ago when subscriber numbers went down and the market lost its belief in Netflix’s magical ability to always grow its paying subscriber numbers now looks like an avoidable blip if it had timed its moves just slightly differently.

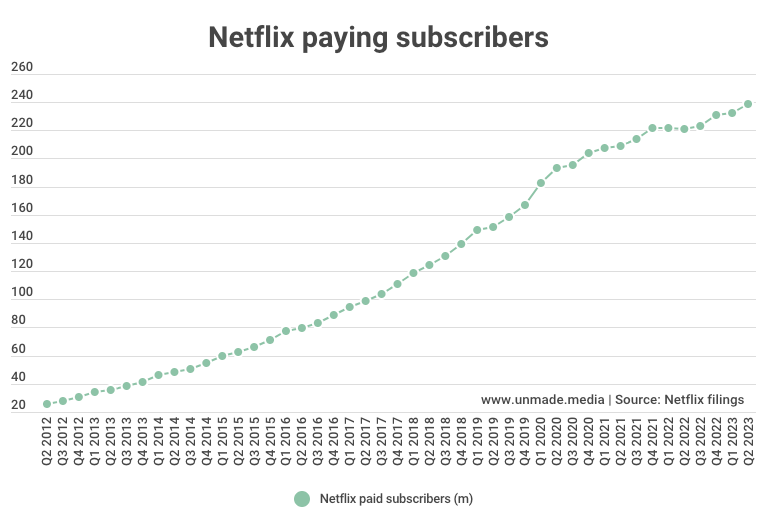

Yesterday the company updated the market. Netflix grew its global number of paying subscribers to 239.39m households. That’s up by 5.9m on the previous quarter, and by 17.7m on that calamitous quarter a year ago when the number dipped by 1m.

That result a year ago changed the economics around the entire screen industry. Spending on developing a streaming offering to compete with Netflix went from something stock markets like to reward, to something to punish.

Netflix’s closest competitor Disney’s share price is only about 45% of its March 12 2021 peak. Paramount Global’s market capitalisation has fallen even further, now sitting at only 16% of its March 19 2021 peak.

Locally, Nine, owner of what had been seen as the growth asset of Stan, is down by a third on where it was when those scary Netflix numbers came out.

Yes, thanks to two screeching handbrake turns, Netflix’s share price has steadily recovered steadily since its big fall on its nightmare quarter.

Introducing a paid advertising tier and cracking down on password sharing have helped turn Netflix company into a growth machine again.

In truth, the story of the new Netflix advertising tier comes in two parts. Yes, the introduction of that ad tier has driven new revenue, but not so much from the advertising itself. It gave the company the chance to bring in a new class of subscribers to the advertising tier who would probably never have paid full freight.

That implies that a typical Netflix ad viewer is likely to have low spending power, which is not an attractive quality for advertisers.

That may be one factor behind the relatively slow growth in actual advertising revenue. As Netflix put it in yesterday’s update, “current advertising revenue isn’t material”.

Netflix is still very much a subscription-first company.

One thing that became clear in yesterday’s update was that the backlash feared from people objecting to the crackdown on password sharing had no negative effect on paying subscribers. For the most part, the whingers were the free riders anyway.

The behavioural economics of the pricing strategy is fascinating. Consumers at the bottom end are being nudged into the ad-led tier. Netflix has decided it makes better economic sense to chase the twin revenues of subscription-plus-advertising at that end of the market.

In Australia Netflix priorities the “Standard with adverts” tier, priced at $6.99 and giving consumers 1080 HD definition, ahead of the $10.99 “Basic” without ads tier, which is in lower definition and doesn’t even show up on the subscription page without an extra click.

Netflix has already deleted the “Basic” ad-free plan in Canada and says it is planning to do the same in the UK and the US. Most likely Australia will follow, as it tries to build that advertising momentum.

Meanwhile, the writers and actors strikes in Hollywood are good for Netflix, at least in the short term. The company’s cashflow will improve in the coming quarters because of the costs it will save on suspended productions.

The investors update also features a chart, which was new to me, of how consumer screen habits have rapidly changed.

The data comes from Nielsen and examines how US screen consumption has hit its inflection point.

In 2021 streaming and broadcast TV were neck-and-neck for screen time, on about a quarter of the pie each. Just two years on, broadcast TV has fallen back to a fifth of screen time, while streaming accounts for more than a third of viewing.

The most fascinating number of all though, comes from what the market still thinks Netflix subscribers are worth.