How the couch won on Black Friday; Uber to look at attention metrics; Pureprofile's new deal

Welcome to a retail media-focused edition of Unmade, in which the REmade team looks back on the lessons of Black Friday and Cyber Monday, and what it means for Christmas shopping season.

This month’s Q&A guest is Uber advertising boss Michael Levine.

Further down in the newsletter: On the Unmade Index, Pureprofile shares jump after it refinances its debt.

Only Unmade’s paying members get full access to all of our content and archives. Upgrade today.

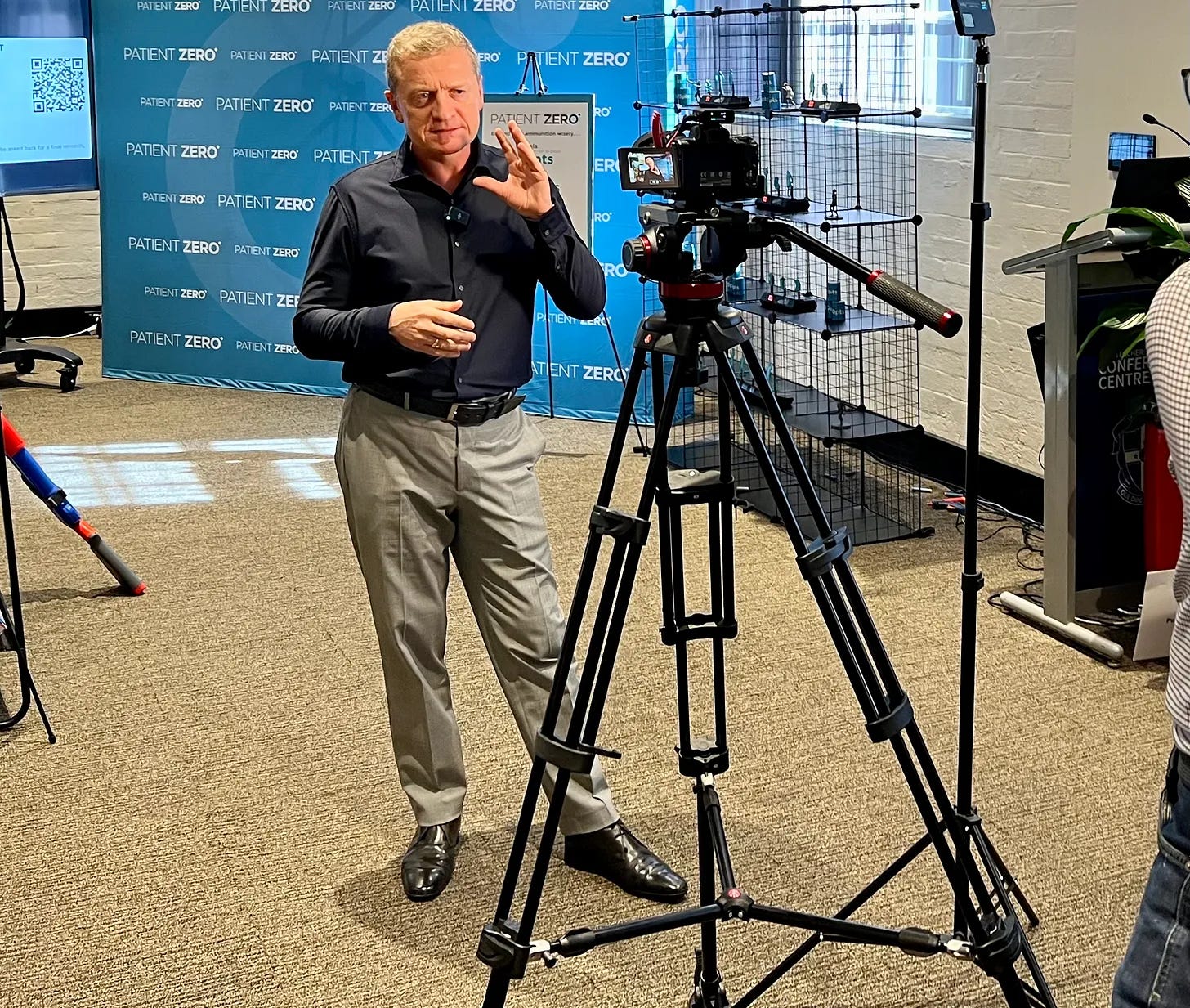

Q&A: Uber’s Michael Levine on building an advertising business from the ground up

In each REmade newsletter we feature a Q&A with a key player in the retail media space. Our guest today is Michael Levine, Uber’s Head of Advertising Sales.

What has changed in retail media over the past 12 months?

Advertising on Uber is a new player in the commerce media landscape, so naturally I’m really excited by the rate of innovation in this rapidly evolving space.

Over the last year, we’ve moved from testing new formats, launching in the market, to now seeing always-on advertiser investment across our retail media offering. So the space is certainly booming. I think that the growth we are seeing here in Australia and NZ comes from a shift in the way marketers invest, but at its core I think it’s a response to the change in consumer behaviours as Aussies and Kiwis find new, easier ways to shop.

What do you see as being the next focus area for the industry?

Not a new focus, but a continued focus on measurement. Given the current macroeconomic environment, it is likely that marketing budgets will be under increased scrutiny and there will be more careful media planning to ensure marketers can demonstrate return on ad spend and sales outcomes.

Not all platforms can be considered for every campaign, however the retail media industry is well positioned given our ability to offer closed loop attribution and connect direct sales results with advertiser investment.

What recent work accomplishment are you most proud of?

Over the last year and a half, I’ve had the great pleasure of attracting incredible talent to come and join the Advertising by Uber team in Australia.

During a difficult period across the marketing and media industry, with unfortunate lay-offs and fiscal tightening, I appreciate the rare opportunity to build an Ads business from the ground up. Uber continues to make significant investments in building the right products and hiring top talent to ensure great outcomes for our advertising partners.

What are you most excited about?

It’s a joy to see a diverse team thriving and delivering strong results with much more to come in 2024. I’m also excited to see more brands bring their creative storytelling and messaging to our consumer delivery marketplace and rides ecosystem as we launch video formats on Uber Rides next year.

What are your expectations for 2024?

From speaking with marketers and their media agency partners, it’s clear that measuring consumer attention will continue to present challenges, but ultimately lead to more effective media investment. We’ve always known that not all environments and formats are created equal - but I think that the industry is finally ready to go deeper in making sure we spend dollars where it counts. Attention metrics are difficult to track and embrace, but I expect to be spending more time thinking about where we can support that in 2024.

How do you see AI impacting retail media?

The use of AI and machine learning to analyse customer data for more effective prospective consumer targeting will continue to be a positive outcome of the AI transformation. Likewise, the ability for retailers and platforms like Uber to better utilise consumer data to deliver more personalised purchasing experiences is only going to provide a better experience for customers.

Black Friday and Cyber Monday: The data so far

In his regular column for REmade, global retail media consultant Colin Lewis looks at the early results from the Black Friday and Cyber Monday sales

All the forecasts have been pointing to eCommerce as the key driver of growth in retail over the next couple of years.

But forecasts are one thing. What about the here and now; the reality of Black Friday Cyber Monday (BFCM)?

Coinciding with the US Thanksgiving holiday weekend, the Black Friday sale was seven days ago, on November 24, while Cyber Monday was this week. Traditionally, Black Friday took place in store while Cyber Monday was online, but now the two have begun to come together.

The early stats are in. They show that US retail store growth was flat, but eCommerce overall is up by a much larger percentage.

Adobe Analytics were first off the press claiming that across 18 different categories, their data showed:

A 5% increase year over year on Thanksgiving,

An increase of 8% on Black Friday.

A further 8% over the weekend - a whopping $10.3 billion over Saturday and Sunday.

So all the indications were that there was really strong growth online.

Mastercard’s Spending Pulse data also reported that Black Friday eCommerce sales had increased 8.5% year over year, while in-store sales increased 1.1%.

What are the biggest drivers?

The biggest driver is discounting - discounts of around 20% - 25% on products like electronics and toys through the weekend

An increase in buy now, pay later - people leveraging credit and different ways to defer payments to be able to take advantage of some of those good deals

Consumers are valuing convenience and using eCommerce to buy: "why get off the couch to get the same discounts I can get on the couch?" as Rick Watson, eCommerce guru called it.

Cyber Monday is going to look like a more muted version of Black Friday because most consumers knew what the best deals were the week before Black Friday, and so they could prepare for what to buy sooner, and what to buy at the peak.

Adobe is expecting Cyber Monday to be in excess of $12bn - higher than initial projections. And it would also make this year's Cyber Monday the biggest online shopping day of all time, and surpassing the e-commerce spend on Black Friday.

The impact of eCommerce means that Cyber Monday is still significant and offers "last chance" shopping. But as Rick Watson points out, "Cyber Monday used to be the digital version of Black Friday, but we seem to have just had that - on the actual Black Friday.

However, Adobe say that Cyber Monday online spending will top $12 billion, making it the biggest US eCommerce shopping day ever.

In reality, the results won't really be counted for weeks yet, if you include inevitable returns.

However, one thing is for sure, eCommerce is the driver of growth in Retail - even during BFCM.

Pureprofile leads the Index after new debt deal

Seja Al Zaidi and Tim Burrowes write:

One of the slowest weeks of the year for the Unmade Index continued on Thursday with a drop of 0.23% to 602.8 points.

Like the day before, around half of the stocks on the index - which tracks Australia’s ASX listed media and marketing companies - did not move.

One of the three stocks to improve was research house Pureprofile, which rose by 7.41% after telling the market it had agreed a three-year, $3m debt facility with CommBank. During previous board turbulence the company had struggled to get facilities with top tier lenders.

ARN Media climbed 1.06%, and Southern Cross Austereo 0.96%.

Enero Group had the largest fall in share price - 2.16% - while Domain followed with a 1.16% drop. IVE Group fell 1% and Ooh Media 0.69%.

Time to leave you to the first day of summer.

We'll be back on the second day of summer (which is very likely to be tomorrow) with Best of the Week.

letters@unmade.media