Welcome to Best of the Week, written on Friday afternoon and this morning in beautiful Sisters Beach, Tasmania. My apologies that we’re a little later than normal; crunching the ATO numbers we talk about below took a lot longer than I anticipated.

Today: Digging deep into the tax transparency data, and what it tells us about the state of Australia’s media players. And why ARN Media shareholders are the ones winning the merger mania.

Happy World Pets Day for tomorrow.

It’s your last chance to sign up to a paid membership of Unmade and lock in all of the current benefits. Later this month, we’re going to stop accepting new paying members of Unmade. Instead we’ll be offering membership of an expanded Mumbrella Pro as we bring the two brands closer together.

All Unmade membership perks will be carried across, including complimentary tickets to REmade, Unlock and Compass for our annual paying members. These won’t be available to anyone else as part of the new Mumbrella Pro membership.

Your paid membership also includes exclusive analysis and access to our content archive, which goes behind the paywall six weeks after publication.

Upgrade today.

Seven things we learned about media from the ATO data

This week’s release of the annual Australian Taxation Office data on the country’s big companies provided a treasure trove of information we don’t usually see on our non-listed businesses.

Of the 4,200 companies covered by the report, about 60 of them have at least a foot in the media and marketing world.

The numbers don’t offer the full picture, particularly when it comes to international companies. When the revenue is booked off shore, as is notoriously the case for much of Google’s revenue, it doesn’t show up in the accounts, or indeed in the tax liability. The info is also more than 12 months old, covering the 2023-24 tax year.

Nonetheless, we learn new things. Here’s what I came across:

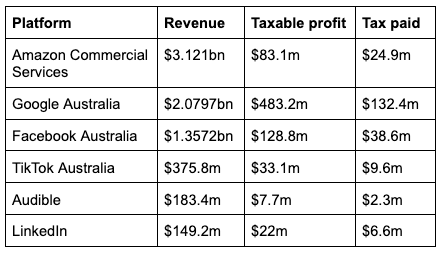

1. TikTok is rising fast but the platforms aren’t paying much tax

With revenue of $375.8m, TikTok is now a major player in the market.

In this table, I’ve chosen to include Amazon Commercial Services. However, that includes both the Amazon Ads revenue from its retail operation, plus its retail media income. The advertising tier of Prime Video had not been switched on during the period covered.

AWS, Amazon’s cloud computing service, is even bigger, writing a further $3.4bn in revenue.

As I mentioned above, assume that Google’s real revenue out of this market could be four or five times that shown here. Meanwhile, Spotify does not appear in the ATO report at all - I suspect that means the company is directly offshoring most of its revenues

What’s noticeable is that in the five platforms included above, they account for revenue out of Australia of more than $7bn, yet paid a total of just $212m in local tax.

That’s less than the $220.6m paid by the News Corp aligned REA Group on its own.

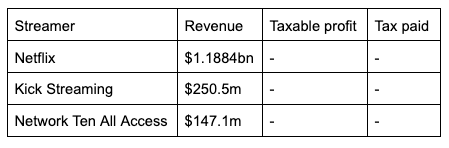

2. Streaming stumbles

Within the screen sector, Netflix is the poster child for a need to switch to a tax on local revenue rather than local profits. It’s too easy for the global platforms to recharge their local subsidiaries for their products at whatever rate they choose, leaving no taxable profit.

Netflix paying zero tax on $1.2bn in local revenue is a disgrace. In 2024, Netflix made a global profit of $10bn on $39bn in revenue. That’s a profit margin of 27%. Apply the same ratio to the company’s Australian revenue, and that would have been a profit of $320m, resulting in what should have been roughly $100m in local tax.

The data also offers a hint of how Paramount+ is faring. All Access was the previous branding for the streaming service. Network Ten All Access wrote revenue of $147.1m. As an additional point of comparison, Stan saw revenue of $448m in FY24.

And livestreaming service Kick is bigger than you’d think too.

3. Studio businesses mostly don’t pay tax

We also get a picture of how several of the studio players are faring, including ITV Studios and BBC Studios. Most of them are reporting almost zero local profit.

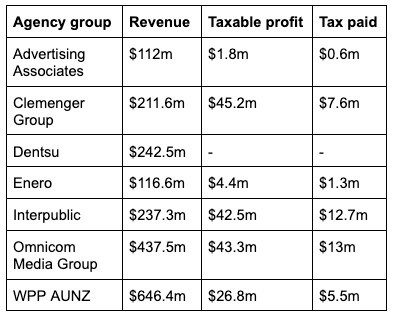

4. Omnicom looms over agencyland

The data adds new information to the progress of the agency groups, although it is still incomplete.

While WPP is the biggest group as a single line with $646.4m in revenue, Omnicom Media Group and its majority owned Clemenger group account for roughly the same as WPP when added together. I suspect that Omnicom’s creative and PR agencies may have another reporting line again, possibly directly in to their parent brands overseas.

Once IPG ($237.3m) officially folds in, Omnicom will be by some way the biggest local player.

Meanwhile, the fact that Dentsu reported no profit is no great surprise. It’s been stuck in a rough patch both globally and locally.

I have no idea why data from Publicis is not available. And my best guess that the reason for the absence of Havas is that it’s too small a business in Australia to be covered.

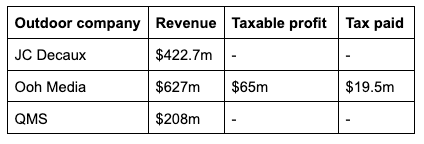

5 Outdoor (in)visibility

We rarely see how outdoor players JC Decaux and QMS are travelling - JC Decaux is owned out of France and QMS is privately held by Quadrant Private Equity.

The data suggests that JC Decaux declared a local loss for 2024 on revenues of $422.7m.

The QMS number in my table does not come from the report, but I have included it from previous AFR reporting as a point of comparison.

It says something about the power of brand marketing that based on trade activity, I would have assumed QMS and Ooh Media were vying for number one in outdoor, with JC Decaux a distant third. Turns out QMS has been punching well above its weight.

6. Low profile, high revenue

The size of several media businesses which normally travel under the radar is eye-opening.

Antony Catalano’s ACM is writing nearly a quarter of a billion dollars in revenue. So too is Are Media.

Bloomberg, Reuters and Reed Elsevier are bigger locally than you’d think.

And remember Yahoo? $116.5m in revenue, but no profitability.

7. TV Times

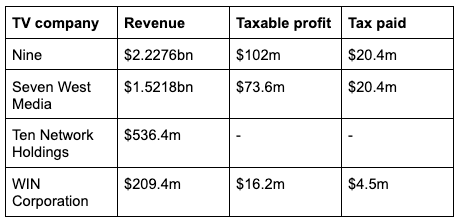

We also got more data about two non-ASX listed companies: Paramount’s free to air arm Ten, and the Gordon family’s WIN Corporation which includes its Nine affiliated regional licences plus radio and production assets.

Policy problems

While the media nerd in me loves the data, the numbers are also infuriating. With every year that passes without reform to tax laws, more untaxed revenue leaks overseas and away from the public purse.

So far the Australian government has shied away from picking a fight with Donald Trump by imposing a digital levy. That’s becoming expensive cowardice.

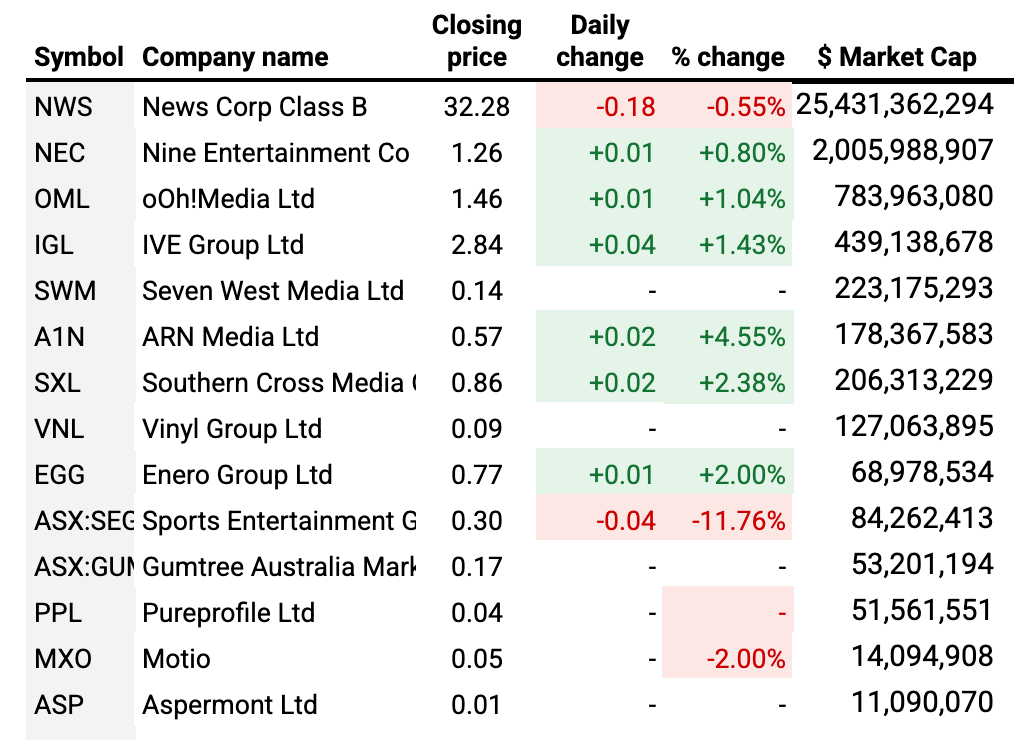

ARN wins the Unmade Index

ARN Media shareholders ended the week as major beneficiaries of the proposed Southern Cross Austereo - Seven West Media merger.

ARN’s share price has risen by 19.8% over the last five days, to its highest point since May, as the market anticipates further consolidation moves. The ARN share price was up by 4.6% yesterday, taking it to a market capitalisation of $178m.

By contrast, SWM is up 7.4% for the week and Southern Cross Austereo is only up 3.6%.

Meanwhile Nine’s market cap has once more broken through the $2bn barrier with the share price improving by 0.8% yesterday, its fifth straight day of improvement.

Outdoor company Ooh Media improved by 1% as it unveiled its new coastline Beaches Network.

Sports Entertainment Group, the owner of SEN Radio network, was the one audio player not to benefit from merger media, losing 11.8% yesterday.

The Unmade Index rose by 0.63% to land on 495.3 points as it edges closer to moving back above the elusive 500-point threshold.

In case you missed it…

On Monday we examined the news that Vinyl Group has bought the URL vinyl.com for $1.6m in shares:

On Tuesday, we shared with our paying members our analysis of the Seven West Media - Southern Cross Austereo merger:

On Wednesday we stuck with radio, exploring the Australian Communications and Media Authority’s plodding oversight of The Kyle & Jackie O Show:

On Thursday we highlighted the highs and lows of Ciaran Davis’s time at the top of ARN, and the challenges faced by his successor Michael Stephenson:

More from Mumbrella…

Ooh Media launches its beaches network across 100 coastal locations

ACM expands agriculture sales division with new leadership appointments

Time to leave you to your Saturday. We’ll be back with more next week.

If you’d like to hear a little more from me in the meantime, last night’s edition of MediaLand on ABC Radio National was thoroughly focused on the radio news of the week. Viv and I talked to former SCA content director Craig Bruce about the implications of the Seven merger; we discussed the ACMA finding against K&J; and we looked back on Ciaran Davis’s career. And we also reviewed the insane (but interesting) 30 minute Gucci-funded movie The Tiger.

And earlier in the week we had a cracking episode of the Mumbrellacast in which we continued the conversation about marketers’ escalating jobs crisis and the implications of the ChatGPT “buy now” button.

You’ll also find me on the Game Changers Radio midweek emergency episode covering the SCA-Seven merger. I’m looking forward to hearing their take on the ACMA in this morning’s episode.

What a week. Bring on the weekend

Toodlepip…

Tim Burrowes

Publisher - Unmade + Mumbrella

tim@unmade.media

My key takeouts - Nine's $2.1bn of local costs are ludicrous, and Seven needs better accountants if they paid the same tax as Nine on nearly 30% less profit!

Infuriating indeed Tim! Whilst there’s doubtless consumer good that comes from the majority of services and key media owners have been either complicit in, or exposed to their likely demise, there’s no escaping the fact that our market, as a consequence of their rise has either lost utility or incurred cost compensation for aggressive market entry. Loss of investigative journalism, diminished local production investment, loss of key classified markets, destruction of the taxi industry, control and shifting of accomodation booking, data and analysis drift, cloud and elastic computing and their inherent market values (with tax payers often on the hook for compensation) and earning capacity for the public purse have all drifted and been allowed to drift off shore.

If we dare mention tariffs/levies we are declared an enemy of America - a country where there are diminishing values in being its friend. A spine in the govt would be welcome in order to help correct a few of these one sided and all too obvious traits and leakage - is anyone paying attention?