Welcome to a Friday edition of Unmade. Today: Unpacking last night’s Foxtel Upfronts event.

Unmade’s paying members get two complimentary tickets to our agenda-setting Marketing in 2023 event promoted in the ad above. At the bottom of this page, you’ll find the discount code you need to access it. Otherwise, tickets are $69 each.

Foxtel gets (further) into the ad game

Nine had a smoke machine.

Paramount had a smoke machine and flame throwers.

Foxtel Group had a smoke machine, flame throwers and fireworks.

If Upfronts season goes on for much longer, it’s going to be possible to see it from space.

Before I go any further, what’s becoming a habitual declaration for the Upfronts: My travel and accommodation for yesterday event was paid for by Foxtel.

Last night, Foxtel welcomed about 500 media and marketing folk to the new Allianz Stadium for an upfronts event it branded as Game Changed. For those who find the locations of their branded Sydney stadiums confusing, that’s the one at Moore Park that used to be Sydney Football Stadium which was knocked down and rebuilt for $0.8bn. It was a good setting, with the scoreboards and stadia signage providing quite the AV backdrop as darkness fell.

Foxtel has a foot in both tribes of television. It’s one of the local broadcast players, with the mature advertising sales house offering that goes with that. And it’s also one of the key subscription streaming players, including entertainment offering Binge and sports platform Kayo.

That streaming context is important. It’s not yet the source of most of the company’s revenue but one day fairly soon it will be. The balance has always been about hanging on to those lucrative broadcast pay TV subscribers while finding new streaming customers at cheaper price points. Advertising has always been the cream on top.

And this week, Netflix said that it has returned to modest growth in subscriber numbers, adding 1m globally.

However, Netflix is predicting that its revenues for this current quarter will fall for the first time, dropping from US$8bn in the last quarter to $7.8bn in the current quarter. Poor old Netflix.

The ad supported tier is Netflix’s new growth story.

And last night, the announcement of an advertising tier for Binge was the most significant thing for Foxtel. The revelation from agency sales boss Nev Hasan got a bigger cheer on the night than details of the content slate. There again, he was talking to an advertising crowd.

The move comes at a similar point to Netflix in the platform’s trajectory, with Binge having also hit a plateau

We’ll have to wait another fortnight or so for majority shareholder News Corp’s quarterly financials to discover whether House of the Dragon took Binge back into growth. I suspect it has.

Unlike Netflix, which has announced a price of $6.99 for its Basic With Ads tier, Foxtel didn’t disclose a price or launch date for the new Binge tier, saying only that it would be in early 2023.

Given that Foxtel Media (what used to be the pay TV sales house MCN) already sells advertising not just on its main broadcast platform but on Kayo, I expect that the tier launch will be smooth from an advertiser perspective. It grows even more what could soon become a glut of ad-supported streaming eyeballs with Paramount’s Pluto TV channels also on the way.

The price point will be interesting. Will the consumers who are willing to tolerate four minutes of advertising be new customers to Binge, or downgraders from more expensive tiers?

For parents who use Binge for children’s programming, the cheaper tier may well be a no brainer. All the kids content will be available, but there will not be any advertising sold against it.

The behavioural economics of discriminatory pricing - finding a way of selling broadly the same service at a slightly lower price point to consumers who otherwise couldn’t afford it - is going to be one of streaming TV’s new strategic marketing challenges.

I’m unsure whether the fact that Netflix and Binge have jumped first is a problem for Nine’s Stan. There may not be much of a first mover advantage to be had.

However, when Nine finally fesses up to the ASX that Stan’s paying subscriber numbers have fallen, it’s going to need a new growth story. An ad-supported tier is one way of offering that.

The positioning of the advertising proposition last night was also interesting. The sell to brands was around it being an alternative to the heavier advertising load of free to air television.

And what of the programming announced last night?

Although it does local content, Foxtel Group’s entertainment offering has primarily been about its overseas studio deals. There was nothing new on the key HBO deal, which can’t have much longer to run now. However, Brian Cox, Succession’s Logan Roy, closed the event with a video message concluded with a perfectly delivered, in character, “Fuck off!”.

For media insiders the most intriguing local content announcement will be Strife - a fictionalised version of the Mia Freedman story, loosely based around the third memoir from the creator of Mamamia, Work Strife Balance. Mia or, rather, Evelyn Jones, will be played by Asher Keddie.

There was also an element of art imitating art. Remember MILF Island from 30 Rock?

Foxtel will produce a local version of FBoy Island, which is already a format in the US, believe it or not. I’m sure you know what the F stands for. Love My Way, it is not.

Returning content to the local slate includes Selling Houses Australia (of course), Gogglebox, and a further season of the Tim Minchin vehicle Upright.

Minchin performed a song on the piano, telling the audience: “It’s good to finally play a stadium”, before adding somewhat wistfully “It doesn’t feel like I thought it would.”

And of course, having bust the bank to renew AFL, Foxtel also went big on its sports rights. I reckon the Foxtel sports promo was the best made sizzle reel of Upfronts season so far.

Speaking of which, there’s just a fortnight remaining of this year’s season. Next week it will be the turn of Seven West Media and Ooh Media, and the following week will see SBS close proceedings.

And then the smoke machines and dry ice will be put away for a while. Sydney’s canape producers deserve the break.

Unmade Index dips

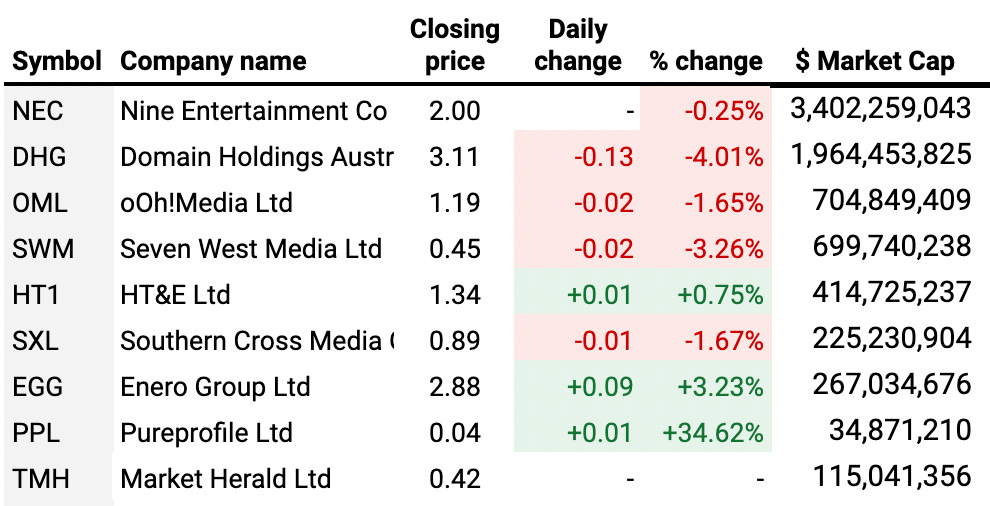

The Unmade Index resumed its downwards trajectory yesterday, falling 0.76%

The biggest fall was Domain, which dropped by 4%, taking it back below a $2bn market capitalisation. Seven West Media slipped back underneath $700m. And Southern Cross Austereo dropped to the lowest market cap in its history of $225m.

Time to let you go about your Friday.

I’ll be back tomorrow with Best of the Week.

A reminder that the code our paying members can use to get two complimentary tickets to our Melbourne event is beneath the paywall at the bottom of this page.

Toodlepip…

Tim Burrowes

tim@unmade.media